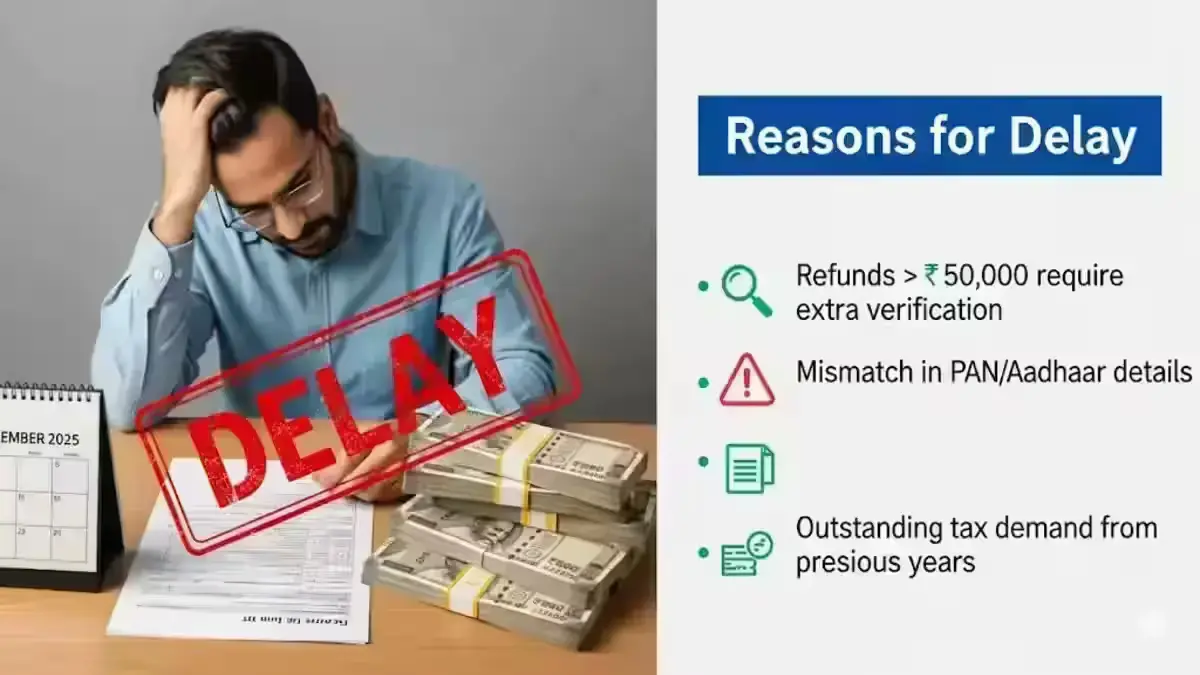

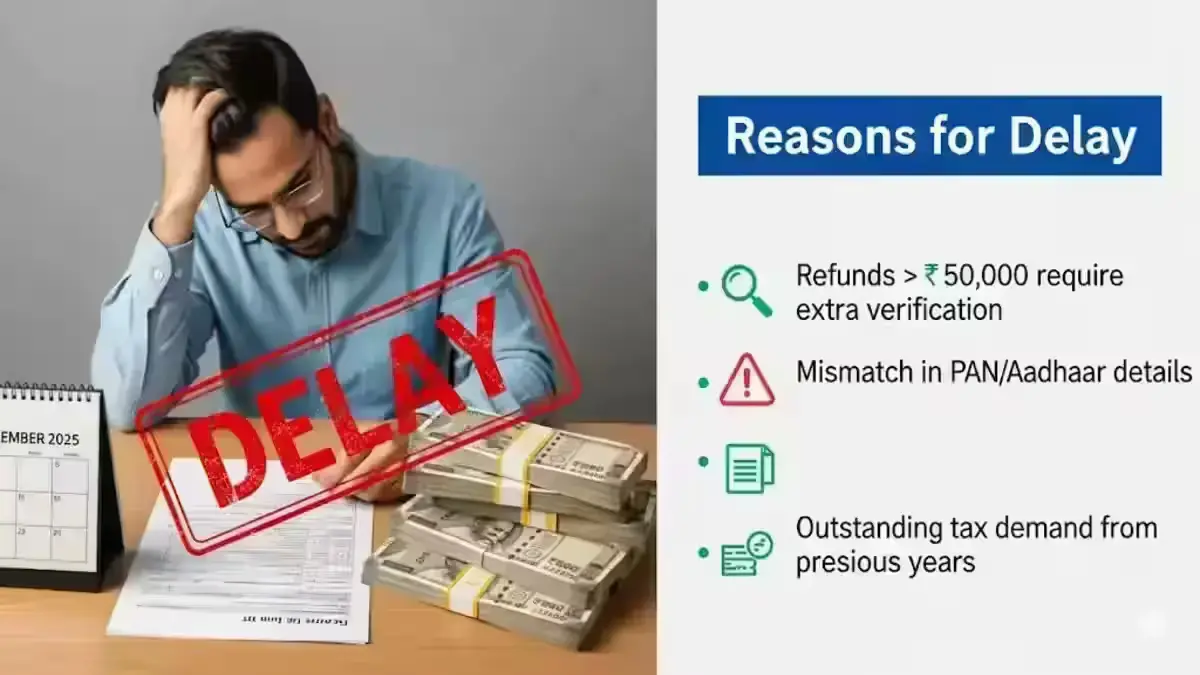

Income Tax Refund Delay 2025: Many taxpayers are reporting delays in receiving refunds, especially for amounts above Rs 50,000. Here’s the latest update, reasons for delay, and what you can do if you missed the September 16 ITR filing deadline.

Income Tax Refund Delay 2025: Latest Update, Date, Timing, and Reasons

About the Income Tax Refund Delay

In September 2025, many taxpayers have reported income tax refund delay despite filing their returns on time. The Centralized Processing Centre (CPC) processes refunds, but larger refunds—especially income tax refund above Rs 50,000—are facing verification checks before being released.

Latest Date and Timing Updates

The Income Tax Department has been processing refunds since July 2025, after the initial ITR filing rush. However, delays have been noted around the September 16, 2025 deadline. Typically, refunds are credited within 30–45 days of return processing, but larger amounts may take longer.

- Refund window: 30–45 days after ITR processing

- For high-value refunds: Additional checks may extend timelines

- Deadline impact: Filing after September 16 can attract penalties

The income tax refund delay can happen due to multiple reasons:

- Refunds above Rs 50,000 require manual scrutiny or extra verification

- Mismatch in PAN, Aadhaar, or bank details

- Outstanding tax demand from previous years

- Technical delays at the CPC during peak filing season

Can You File After the September 16 Deadline?

Yes, you can file a belated return after September 16, 2025, but it comes with conditions:

- A late filing fee under Section 234F will apply

- Interest on tax dues may be charged

- Refund, if any, will take additional time

Understanding the refund process is crucial. Refunds are not just about tax savings but also about liquidity planning. If your ITR refund 2025 is delayed, it is better to check your income tax refund status online at regular intervals to avoid surprises.

Disclaimer

This article is for informational purposes only. Taxpayers are advised to consult the official Income Tax Department website or a qualified tax consultant for personalized advice.

FAQs

Q1: How long will it take to receive my income tax refund 2025?

A: Usually 30–45 days from ITR processing, but refunds above Rs 50,000 may take longer due to additional checks.

Q2: What if I missed the September 16 deadline?

A: You can still file a belated return, but penalties and interest may apply. Refunds may also take more time to be credited.

Q3: How can I check my income tax refund status?

A: You can log in to the Income Tax e-filing portal or the NSDL website to track the latest status of your refund.