Tax audit due date 2025 is approaching soon. Here’s everything you need to know about deadlines, extension updates, Form 3CD changes and compliance rules.

Tax Audit Due Date 2025: Deadline, Extension and Key Updates

About the Tax Audit Due Date

The tax audit due date is an important compliance requirement under the Income Tax Act. Businesses and professionals whose turnover or receipts exceed specified limits must get their accounts audited and submit the audit report in Form 3CD before the deadline. For assessment year 2025–26, taxpayers and professionals are closely monitoring whether the tax audit due date extension will be announced due to technical glitches on the ITR portal.

Tax Audit Due Date 2025 and Timing

The official tax audit due date 2025 is currently set for 30th September 2025. This date applies to businesses and professionals who are required to submit their tax audit reports for AY 2025–26. The deadline usually falls at midnight of the last date, meaning all filings must be completed online before 11:59 PM of the due date.

Key Updates and Deadline Extension Requests

Several trade bodies and tax professionals have requested the government to extend income tax audit deadline due to ITR portal glitch and errors in AIS/TIS reports. The Institute of Chartered Accountants of India (ICAI) has also raised concerns about enhanced reporting requirements. While there is no official extension yet, updates are expected as the deadline approaches.

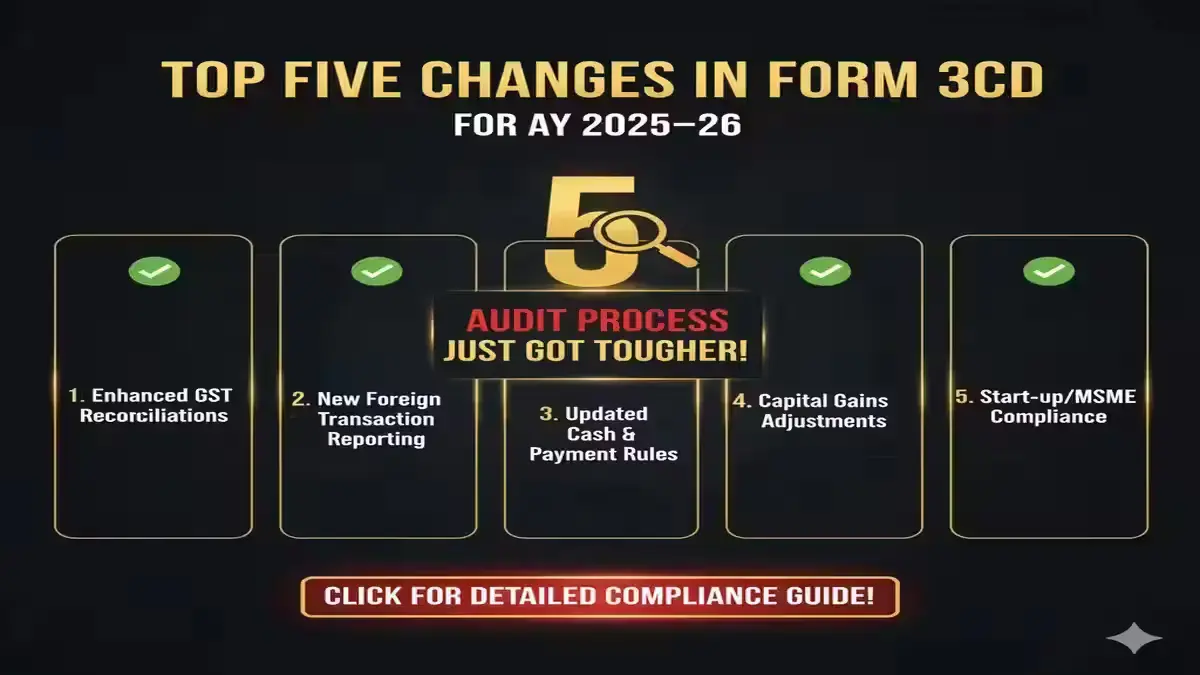

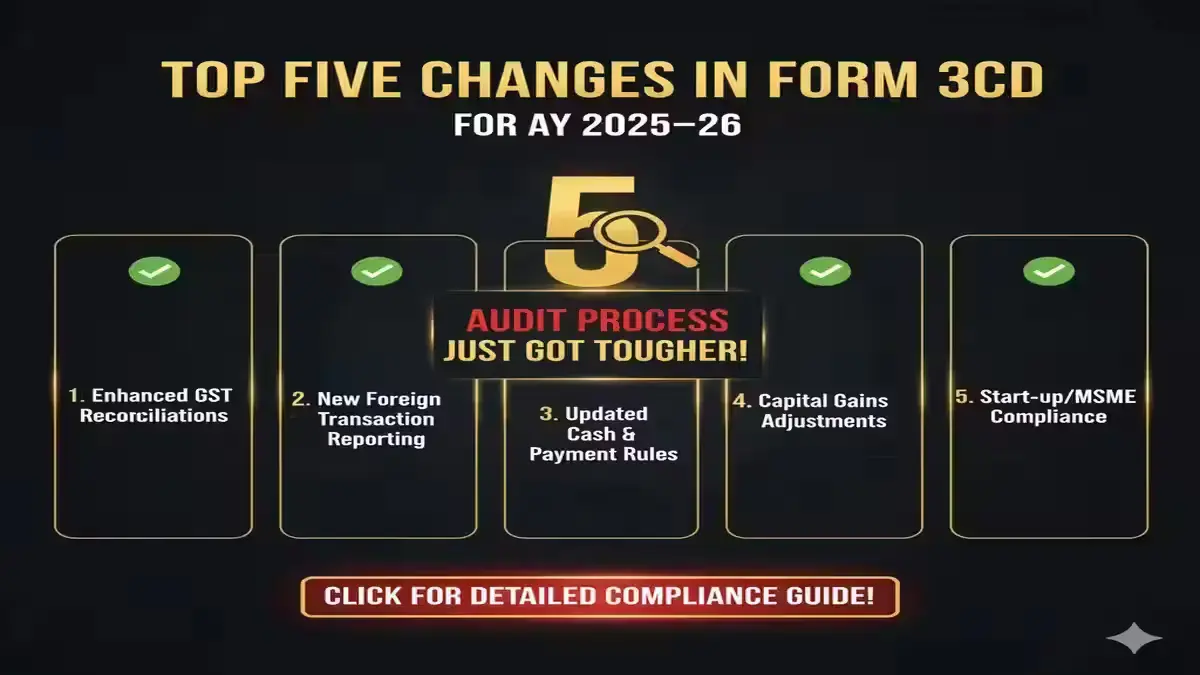

The audit process now involves revised reporting standards. The top five changes in income tax audit form 3CD for AY 2025–26 include:

- Enhanced disclosure of GST-related reconciliations

- New reporting requirements for foreign transactions

- Updated clauses on cash transactions and payments

- Changes in reporting of capital gains adjustments

- Additional compliance checks for start-ups and MSMEs

Importance of the Tax Audit Due Date

- Avoid penalties under Section 271B

- Maintain a clean compliance record

- Ensure smoother processing of ITR filings

- Stay updated with evolving tax rules

Disclaimer

The information provided here is based on updates available at the time of writing. The government may announce further clarifications or extensions. Taxpayers are advised to check official notifications from the Income Tax Department for the latest updates.

FAQs

Q1: What is the tax audit due date for AY 2025–26?

The tax audit due date for AY 2025–26 is 30th September 2025, unless extended by the government.

Q2: Is there an extension of the tax audit due date in 2025?

As of now, no official extension has been announced. However, due to ITR portal glitches, industry bodies have requested an extension.

Q3: What are the top changes in Form 3CD for AY 2025–26?

Key changes include enhanced GST disclosures, new reporting for foreign transactions, adjustments for capital gains, and compliance updates for MSMEs.