GST cuts update 2025: Check the latest timing, date, benefits, and reasons behind the new GST reforms impacting insurance and healthcare policies.

GST cuts 2025: Timing, Date, Benefits and Latest Update

About the GST Cuts Announcement

The government has introduced fresh GST cuts in 2025, focusing on insurance and healthcare services. These changes are expected to reduce costs for policyholders and bring relief to consumers. Industry experts, including Edme Insurance Brokers, suggest that these cuts will create long-term benefits by making health and life insurance more affordable.

Date and Timing Details

The revised GST structure officially came into effect on September 22, 2025. All gst payment processes from this date onward must comply with the updated rates. The announcement was timed to align with the start of the festive season, a period that traditionally sees higher spending and financial activity.

Benefits of the GST Cuts

Benefits of the GST Cuts

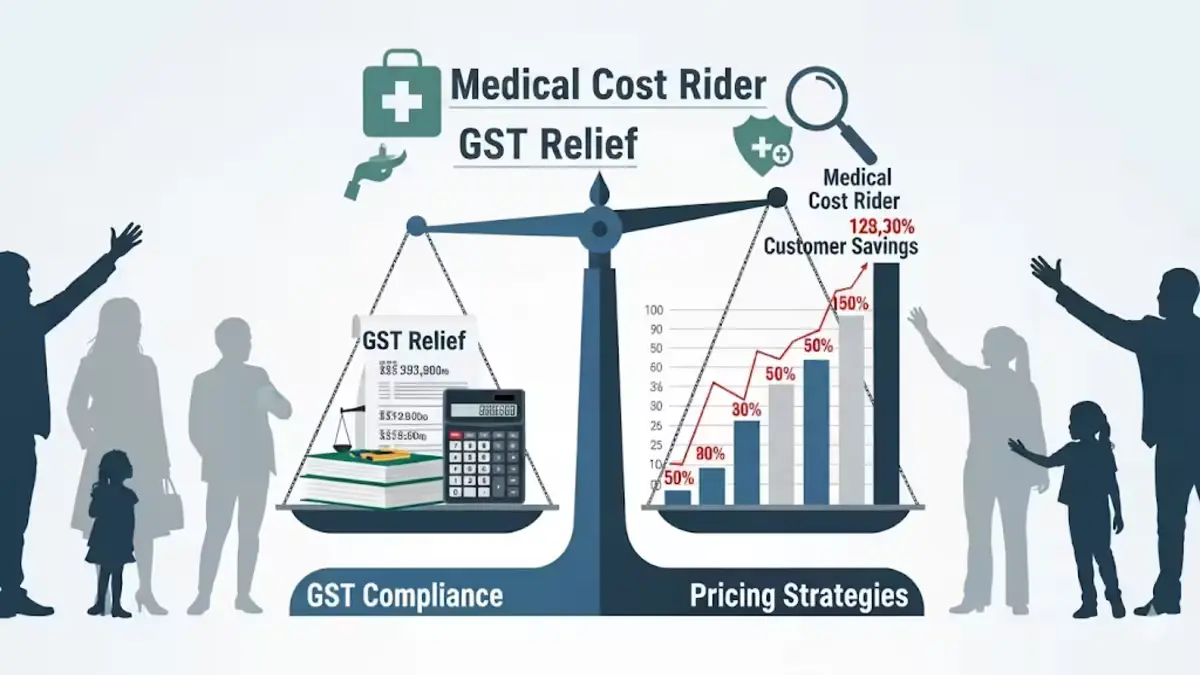

- Lower Insurance Costs: The medical cost rider in GST relief ensures that health-related insurance riders become more affordable.

- Customer-Centric Reforms: Insurers are expected to pass on the benefits directly to customers, easing premium costs.

- Streamlined Payments: Simplified structures in gst payment make compliance easier for both individuals and companies.

“The actual benefit of GST cuts for policyholders will depend on how insurers adjust their premiums, especially after the removal of input tax credit on commission,” said industry experts at Edme Insurance Brokers.

Reasons Behind the GST Cuts

The government introduced these GST reforms for several reasons:

The government introduced these GST reforms for several reasons:

- To reduce the financial burden on middle-class families purchasing health and life insurance.

- To improve participation in insurance coverage across sectors.

- To adjust fiscal policies in response to rising healthcare costs.

“While GST relief includes a medical cost rider, the extent of savings for customers will vary, as insurers must balance compliance with pricing strategies,” noted an official source on GST reforms.

Key Updates and Changes

- No Input Tax Credit on Commission: Effective September 22, 2025, insurers offering individual health and life policies will not be allowed to claim input tax credit on commission payments.

- Medical Cost Rider in GST Relief: Policyholders opting for health riders will see reduced GST charges.

- Industry Adjustment: While insurers will bear some additional costs, the long-term benefit is expected to favor customers.

“Consumers may see lower costs under the new GST cuts, but the full impact hinges on insurers’ decisions in light of the no input tax credit rule,” explained a senior insurance official.

Importance and Significance

Importance and Significance

The GST cuts are significant for both consumers and the insurance sector. They ensure that policies are more accessible, support long-term savings, and encourage wider adoption of insurance products. For businesses, the changes bring clarity on compliance rules and help align with the broader goals of GST reforms.

Disclaimer

The information provided is based on official government announcements and industry inputs. Readers are advised to verify details with certified tax professionals or official GST notifications before making financial decisions.

FAQs

Q1: From when are the new GST cuts effective?

The new GST cuts came into effect on September 22, 2025.

Q2: What is the benefit of the medical cost rider in GST relief?

It reduces GST charges on healthcare-related insurance riders, making policies more affordable for customers.

Q3: Why was the input tax credit on commission removed?

The government removed it to streamline GST compliance and reduce indirect benefits for insurers, ensuring cost savings reach customers directly.