Aadhaar PAN Link Deadline 2025 and Bank KYC Changes from November 1

Discover Update: From November 1, 2025, several major banking and KYC rules will change across India. Aadhaar–PAN linking is now mandatory, and failing to comply could result in your PAN becoming inactive by January 2026.

The government of India has once again reminded taxpayers and account holders about the aadhaar pan link deadline 2025. As per new guidelines, if you fail to link your PAN with Aadhaar before the cut-off, your PAN will be blocked, affecting your banking transactions, tax filing, and UPI operations.

Key Changes in Bank KYC from November 2025

Starting November 1, 2025, several bank rules from November 1 India will take effect. Banks such as Yes Bank and other major private lenders have updated their KYC norms. Customers must ensure that their PAN and Aadhaar are linked to continue using internet banking, mobile apps, and UPI services without disruptions.

Mandatory Aadhaar Authentication for New PAN

The Income Tax Department has made mandatory Aadhaar authentication for new PAN applications. This means every new PAN issued must be verified through biometric or OTP-based Aadhaar verification. The step aims to reduce duplicate PAN cards and prevent misuse.

Aadhaar Biometric Update Fee and Process

According to the UIDAI, the aadhaar update fees new from November will apply for biometric updates and address corrections. Users can visit their nearest Aadhaar Seva Kendra or use the online portal for updates. The biometric update fee details are ₹50 for demographic changes and ₹100 for biometric revalidation.

Banking App and UPI Glitches: Why KYC Matters

Many customers have reported issues with UPI glitches and banking errors when their KYC is incomplete or outdated. To avoid interruptions in transactions, banks recommend updating KYC details through their official bank app or by visiting the branch before November 2025.

Banks Allow Up to Four Nominees

In a positive move, RBI has permitted banks to nominate up to four nominees for savings and fixed deposit accounts. This change ensures smoother settlement for family members in case of emergencies.

What Happens If PAN Becomes Inactive in January 2026?

If your PAN is not linked with Aadhaar by the final aadhaar pan link deadline 2025, it will become inactive from January 2026. This means you won’t be able to open new bank accounts, file income tax returns, or complete any major financial transaction.

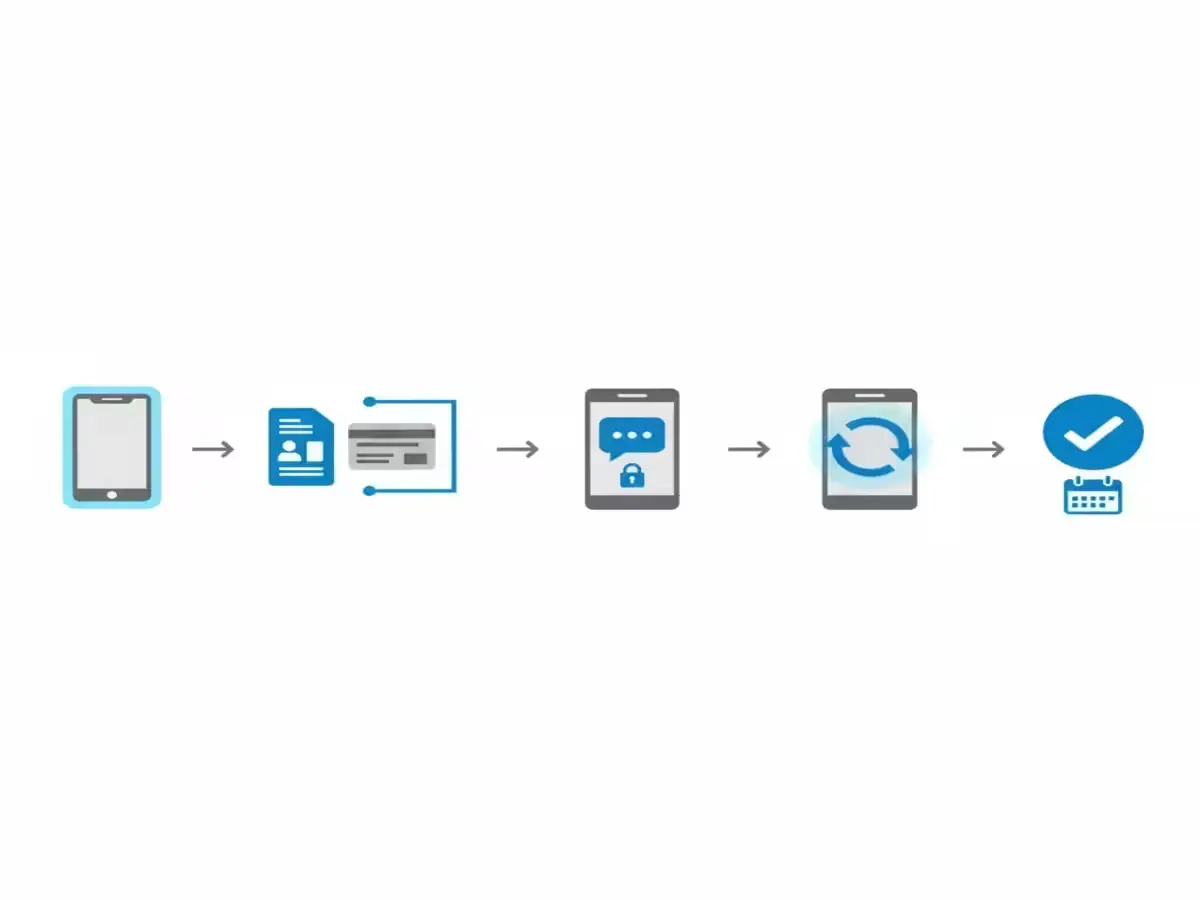

How to Link Aadhaar and PAN Online

Here’s a quick guide on how to link Aadhaar and PAN online:

- Visit the official Income Tax e-filing website.

- Click on “Link Aadhaar and PAN”.

- Enter your PAN, Aadhaar number, and mobile OTP.

- Pay the nominal linking fee if prompted.

- Submit and confirm. You’ll receive a confirmation message once linked.

Disclaimer

This article is for informational purposes only. Always verify the latest updates from your bank and the Income Tax Department before making any changes.

FAQs on Aadhaar PAN Link Deadline 2025

1. What is the last date to link Aadhaar and PAN?

The final deadline is expected to be December 31, 2025. After this, PAN may become inactive by January 2026.

2. Can I link Aadhaar and PAN using my mobile app?

Yes, most banks like Yes Bank and HDFC provide the option to update KYC and link Aadhaar through their mobile apps.

3. What if my PAN gets blocked?

If your PAN becomes inactive, you won’t be able to conduct any high-value financial transaction until it’s reactivated.

4. Are there new Aadhaar update fees from November 2025?

Yes. From November 2025, the biometric update fee is ₹100 and the demographic update fee is ₹50.

5. How can I avoid UPI glitches due to KYC?

Ensure your Aadhaar, PAN, and mobile number are updated in your bank account before November 2025.