Quick Snapshot:

- IPO Size: ₹3,600 crore (Offer-for-Sale)

- Price Band: ₹378–₹397 per share

- Lot Size: 37 shares (Retail ₹14,689 minimum)

- GMP Today: ₹60–₹62 (around 15% listing premium expected)

- Listing Date: November 19, 2025

Tenneco Clean Air IPO Opens — Is This Auto Component Giant The Next Value Pick?

The Tenneco Clean Air IPO has opened for subscription, drawing attention from retail and institutional investors alike. The company’s clean-air systems play a key role in modern automotive exhaust technologies, and its India listing marks a major step toward expanding its local footprint. With a ₹3,600 crore Offer-for-Sale, many are watching how the market responds to this new listing opportunity.

About Tenneco Clean Air

Tenneco Clean Air India manufactures emission-control and exhaust systems used by major automobile manufacturers. The company focuses on clean-air technologies that help vehicles meet evolving emission norms. It operates under the global Tenneco brand, known for its decades of expertise in automotive components and sustainable manufacturing practices.

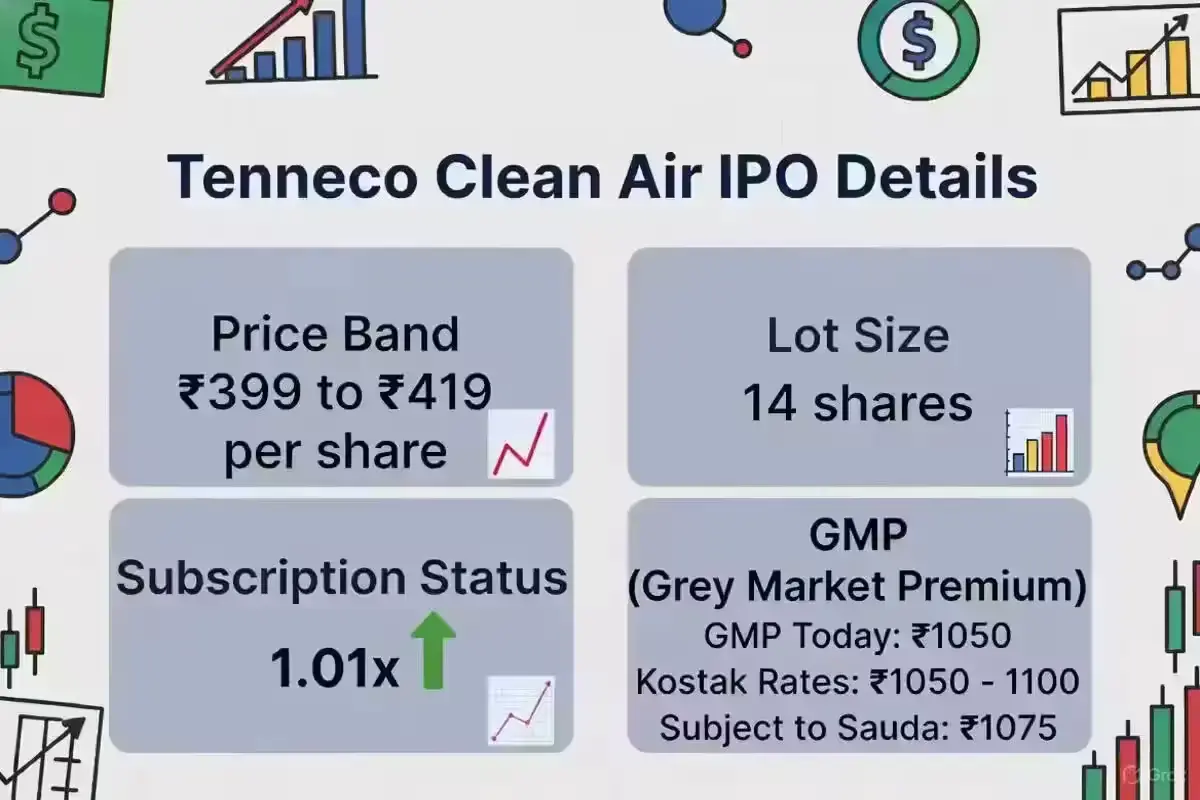

IPO Details and Price Band

The Tenneco Clean Air IPO is valued at around ₹3,600 crore, structured entirely as an Offer-for-Sale. The price band is set between ₹378 and ₹397 per share, with a minimum application lot size of 37 shares. This means a retail investor will need approximately ₹14,689 to participate at the upper price band.

The issue opens for subscription on November 12 and closes on November 14, with listing expected on November 19, 2025. Early anchor investments have already shown solid demand, adding to investor curiosity around the public offering.

Grey Market Premium (GMP) Today

The Tenneco Clean Air IPO GMP today is hovering around ₹60 to ₹62, suggesting a possible listing premium of nearly 15% over the upper band. While GMP isn’t always a guaranteed indicator, it gives an idea of current market sentiment toward the issue.

Subscription Status and Market Sentiment

Initial subscription figures indicate healthy retail and institutional interest. Many investors see potential in the company’s positioning within the automotive clean-air technology segment, especially as emission norms tighten in India. However, some are cautious about the IPO being a full OFS, meaning no fresh capital will flow into business expansion.

Comparison with Gold Prices Drop

Interestingly, this IPO comes at a time when gold prices have seen a mild correction in India. As investors move part of their capital from safe-haven assets toward equities, new IPOs like Tenneco Clean Air are benefitting from renewed attention. Some investors view this as a potential diversification play amid shifting commodity trends.

Dividend, Bonus & Multibagger Angle

Since this is the company’s first public issue in India, there is no track record of dividends or bonus shares yet. Investors expecting short-term multibagger returns may need to temper expectations. The company’s long-term potential lies in how it navigates the transition to electric mobility while continuing to grow in clean-air and emission systems.

Review – Should You Apply?

The fundamentals look steady. The company has strong relationships with OEMs, consistent revenue growth, and operates in a niche segment with clear regulatory tailwinds. However, dependence on internal combustion vehicle sales and lack of fresh capital infusion may limit short-term upside.

For long-term investors looking to ride the clean-mobility trend, the Tenneco Clean Air IPO could be worth considering in moderation. Listing gains are possible, but it’s more of a steady growth story than a quick windfall.

Frequently Asked Questions (FAQ)

Q1. What is the price band for the Tenneco Clean Air IPO?

A: The price band has been fixed at ₹378 to ₹397 per share.

Q2. What is the lot size and minimum investment required?

A: Investors can apply for a minimum of 37 shares, which requires an investment of approximately ₹14,689 at the upper price band.

Q3. What is the GMP (Grey Market Premium) today?

A: The latest GMP is around ₹60–₹62 per share, indicating a possible listing gain of about 15%.

Q4. Is Tenneco Clean Air offering fresh shares in this IPO?

A: No. The entire issue is an Offer-for-Sale, meaning no new funds will be raised by the company.

Q5. When does the Tenneco Clean Air IPO open and list?

A: The IPO opens on November 12, closes on November 14, and is expected to list on November 19, 2025.

Disclaimer: This article is for educational and informational purposes only. It should not be considered as investment advice. Please consult your financial advisor before investing.