Binance Responds to Depeg Incident, Announces Compensation Plan

After a volatile trading session, Binance confirmed that several tokens — including USDE, BNSOL, and WBETH — temporarily lost their expected peg. This led to forced liquidations and sparked questions about how such events are managed on the exchange. Within hours, CEO Richard Teng responded, assuring users that Binance would take responsibility and compensate eligible traders.

What Led to the Depeg

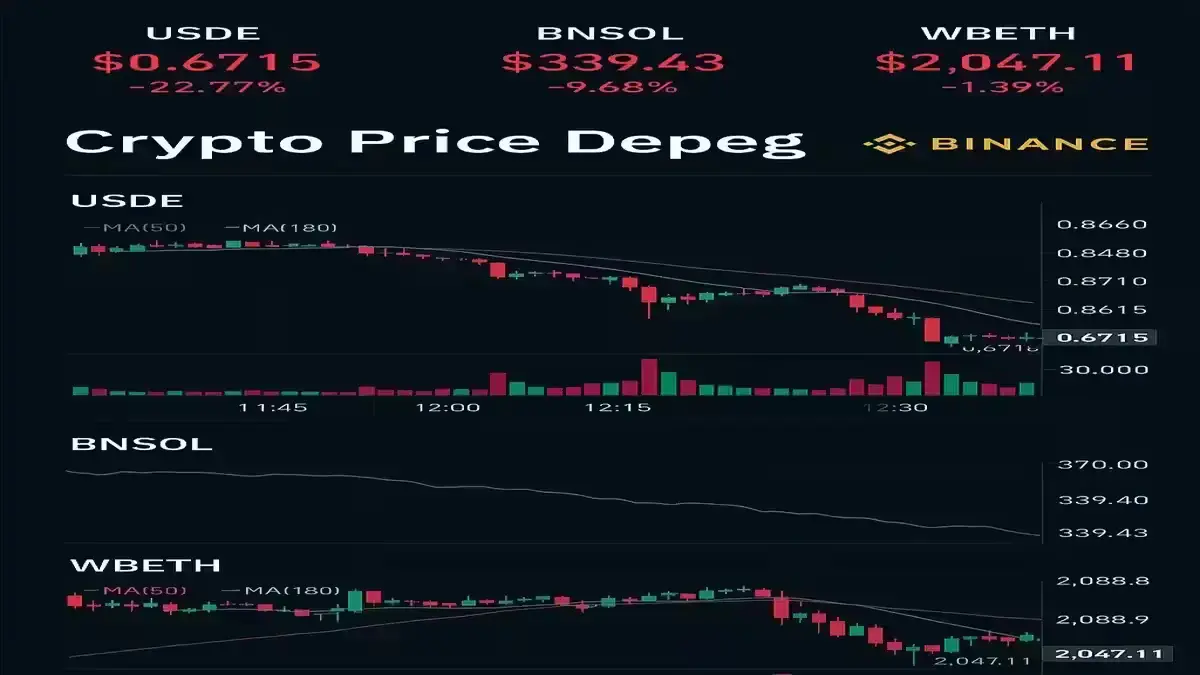

The depeg happened during high market volatility, when prices of the three tokens fell below their intended reference levels. USDE, meant to stay near $1, briefly dropped below $0.70. BNSOL and WBETH — both staking-based assets — also slipped from their pegged ratios, triggering automatic liquidations for users holding leveraged positions.

Richard Teng’s Statement

Richard Teng, who leads Binance after taking over in late 2023, acknowledged the incident on social media. He stated that there were “no excuses” and that Binance would prioritize user protection. His tone was direct, focusing on restoring trust after the disruption. Teng also emphasized that Binance’s scale as the world’s largest cryptocurrency exchange demands greater responsibility during uncertain market periods.

Compensation and Support

Binance confirmed that impacted users from Futures, Margin, and Loan accounts would receive compensation. The exchange will cover losses between the liquidation price and the reference market value set at 00:00 UTC on October 11. The process is expected to conclude within 72 hours of the announcement.

Users who believe they were affected outside the official compensation window have been advised to reach Binance customer support directly for review.

Market Reactions and Token Prices

Following the event, WBETH price and BNSOL recovered gradually, though market sentiment remains cautious. Traders have pointed out that derivative tokens are inherently vulnerable to liquidity gaps when redemption rates fluctuate. Binance said it is now integrating redemption data into index pricing to avoid sudden mismatches.

Risk Control Measures and Next Steps

To prevent future depegs, Binance will update its risk management system. Planned measures include using weighted redemption prices, adding minimum price thresholds, and increasing the review frequency for index parameters. These actions are designed to ensure price stability and improve transparency for traders globally.

Final Take

This episode serves as a test for Binance’s credibility. By committing to compensate users and tightening controls, the exchange aims to reinforce its position as a trusted global platform. While some traders see the compensation as a positive sign, others remain watchful to see how Binance handles similar risks in the future.

Frequently Asked Questions

Q: What exactly happened during the Binance depeg event?

A: Several tokens – USDE, BNSOL, and WBETH — lost their intended peg values, causing forced liquidations for leveraged traders on Binance.

Q: How is Binance compensating users?

A: Affected users will be reimbursed based on the difference between the liquidation price and the reference price as of October 11, 00:00 UTC.

Q: Who is Richard Teng?

A: Richard Teng is the CEO of Binance, responsible for global operations and regulatory communication.

Q: What’s next for Binance?

A: Binance plans to improve risk systems, add tighter index controls, and communicate more frequently with users on potential risks.

Q: Is Binance still the world’s largest cryptocurrency exchange?

A: Yes, Binance remains the largest crypto exchange by trading volume, even after recent market disruptions.