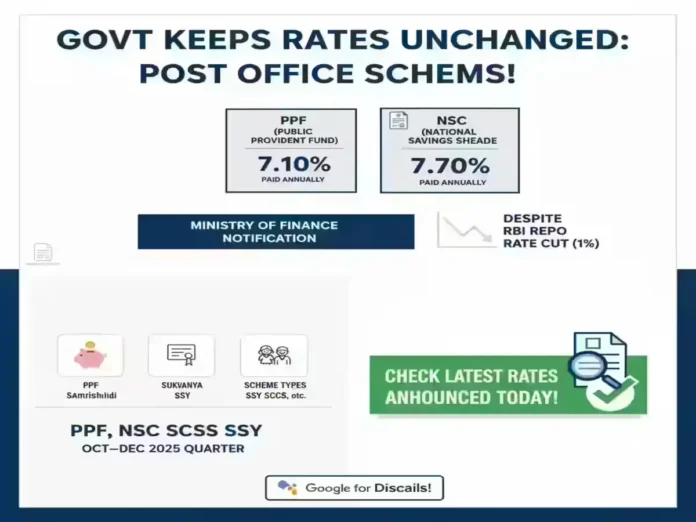

Govt Keeps PPF, NSC, SCSS Rates Unchanged for Oct–Dec 2025

The Government of India has announced that interest rates for all Post Office Small Savings Schemes will remain unchanged for the October–December 2025 quarter. This includes key schemes like the Public Provident Fund (PPF), National Savings Certificate (NSC), Senior Citizens Savings Scheme (SCSS), Sukanya Samriddhi Yojana (SSY), Kisan Vikas Patra, and others.

Latest Post Office Small Savings Interest Rates: Oct–Dec 2025

| Instrument | Interest Rate (%) | Notes |

|---|---|---|

| Post Office Savings Deposit | 4.0 | Regular savings account |

| 1-Year Time Deposit | 6.9 | Short-term fixed deposit |

| 2-Year Time Deposit | 7.0 | |

| 3-Year Time Deposit | 7.1 | |

| 5-Year Time Deposit | 7.5 | |

| 5-Year Recurring Deposit | 6.7 | |

| Senior Citizens Savings Scheme (SCSS) | 8.2 | Targeted at senior citizens |

| Monthly Income Account Scheme | 7.4 | Regular monthly income |

| National Savings Certificate (NSC) | 7.7 | 8-year maturity |

| Public Provident Fund (PPF) | 7.1 | Long-term investment |

| Kisan Vikas Patra | 7.5 | Matures in 115 months |

| Sukanya Samriddhi Yojana (SSY) | 8.2 | For girl child education & savings |

Why Rates Remain Unchanged

Even though the RBI cut the repo rate by 1%, small savings schemes are reviewed quarterly and their rates depend on government securities yields, inflation, and fiscal policies. Therefore, these schemes are not directly affected by repo rate changes.

Impact on Investors

Impact on Investors

Investors, especially senior citizens and low-risk savers, can continue to benefit from stable returns. It’s important to stay informed about quarterly announcements for any future changes.

Disclaimer

This article is for informational purposes only. It is not financial advice. Readers should verify rates and schemes with official sources before making investment decisions.

Frequently Asked Questions (FAQ)

What are the interest rates for Post Office Small Savings Schemes in Oct–Dec 2025?

PPF: 7.1%, NSC: 7.7%, SCSS: 8.2%, SSY: 8.2%, Kisan Vikas Patra: 7.5% (matures in 115 months). Other deposits range from 4% to 7.5% depending on duration.

Why have the rates not changed despite the RBI repo rate cut?

Small savings scheme rates are determined quarterly and are influenced by factors like government securities yields and inflation, not directly by repo rate changes.

How often are these rates reviewed?

The government reviews and announces interest rates for small savings schemes every quarter.

Which schemes are part of Post Office Small Savings Schemes?

PPF, NSC, SCSS, Sukanya Samriddhi Yojana, Kisan Vikas Patra, Monthly Income Account, and various time deposits.

- Where can I check the latest official rates?

- Official rates are published by the Ministry of Finance and can also be checked at local post offices.

- Author: Banking Insights Blog — Financial writer with expertise in small savings schemes and government notifications.

Impact on Investors

Impact on Investors