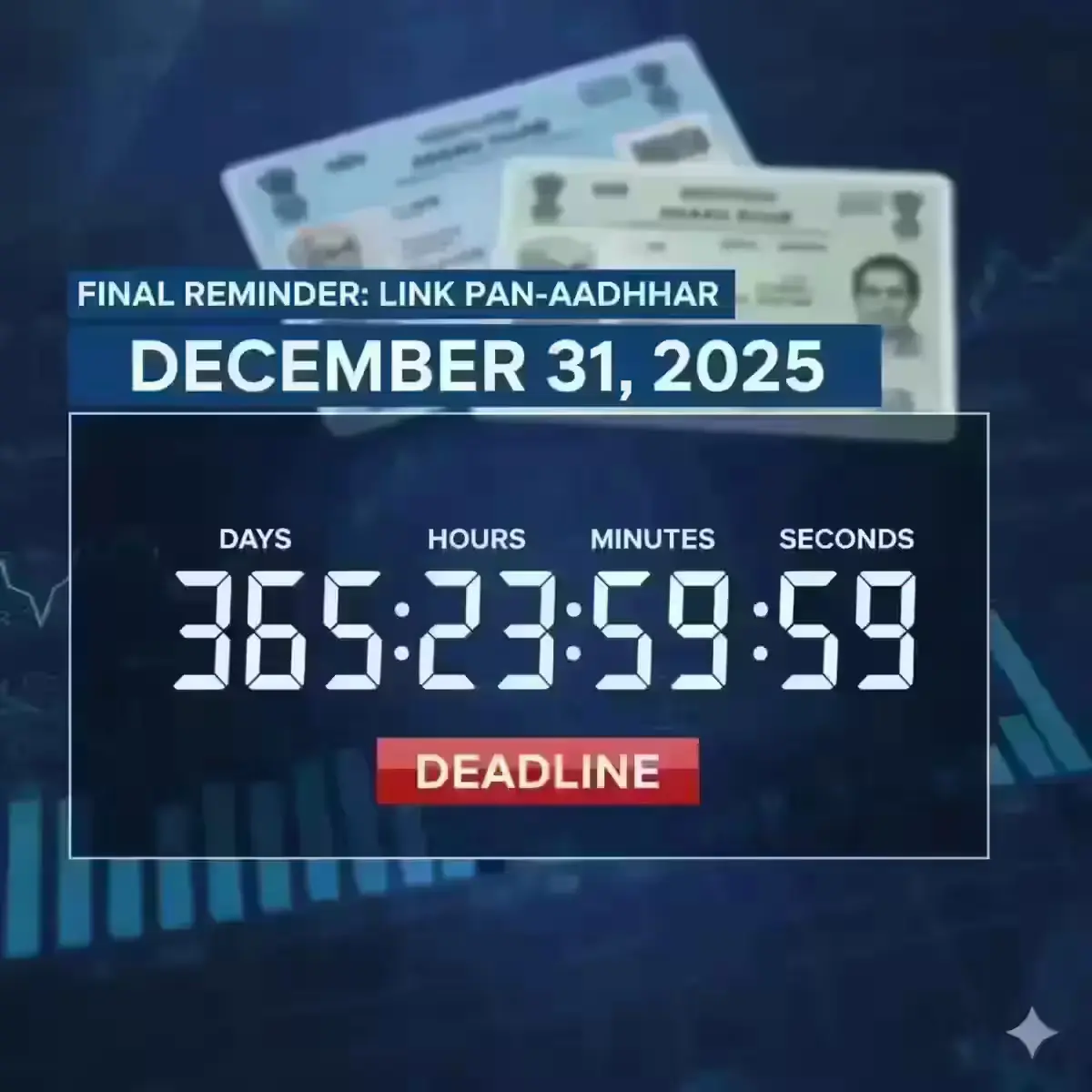

PAN Deactivation Update: The government has confirmed that all unlinked PAN cards will be deactivated from January 1, 2026. The last date for Aadhar Pan Card Linking is December 31, 2025.

PAN Card Deactivated from January 1, 2026: Here’s What You Need to Know

If you haven’t yet linked your PAN card with your Aadhar, it’s time to act fast. The government has once again reminded taxpayers that PAN cards not linked with Aadhar by December 31, 2025, will become invalid starting January 1, 2026. This update affects millions of individuals who use their PAN for banking, investments, and filing income tax returns.

Why Aadhar Pan Card Linking Is Important

The Aadhar Pan Card Linking process was introduced to prevent tax evasion and maintain a single identity across financial systems. A linked PAN helps ensure smooth transactions, tax filings, and verification processes. On the other hand, an unlinked PAN will no longer work for opening a bank account, filing an ITR, or even conducting basic financial operations.

PAN Deactivation Update: Key Dates and Impact

- Last Date for Linking: December 31, 2025

- PAN Deactivation Date: January 1, 2026

If your PAN is deactivated, you may face issues such as frozen bank accounts, failed KYC checks, or rejected income tax returns. To avoid these disruptions, make sure your Aadhar and PAN are linked before the deadline.

How to Check PAN-Aadhar Linking Status

You can easily verify your PAN-Aadhar status online. Visit the Income Tax Department’s official portal and click on the ‘Link Aadhar’ section. Enter your PAN and Aadhar numbers, and the portal will display your current linking status.

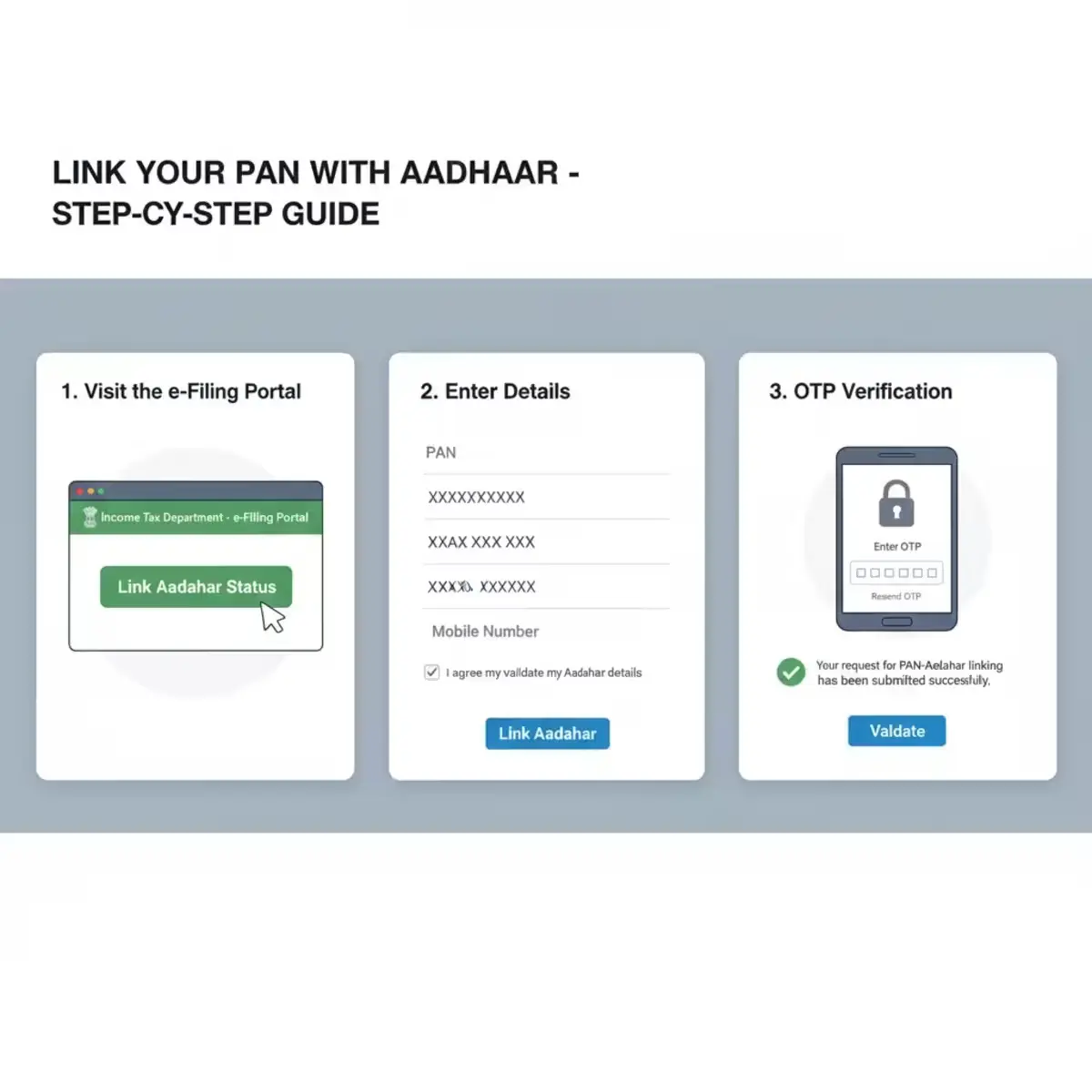

Steps to Link PAN with Aadhar

- Visit the official income tax website – incometax.gov.in

- Click on the “Link Aadhar” option on the homepage.

- Enter your PAN, Aadhar number, and registered mobile number.

- Verify details and submit the request.

- You’ll receive an OTP on your registered mobile for confirmation.

After successful verification, your Aadhar and PAN will be linked within a few days.

What Happens If You Miss the Deadline?

If you miss the December 31, 2025 deadline, your PAN Card will be deactivated from January 1, 2026. You won’t be able to file ITRs, invest in mutual funds, or conduct banking transactions that require PAN. It’s advisable to complete the linking well in advance to avoid any last-minute issues.

Disclaimer

The information shared in this article is based on official government announcements and public domain updates. Readers are advised to verify details through the Income Tax Department’s website for the latest instructions and official notices.

Frequently Asked Questions (FAQ)

1. What is the last date for Aadhar Pan Card Linking?

The last date to link Aadhar with PAN is December 31, 2025.

2. What happens if I don’t link my PAN with Aadhar?

Your PAN will be deactivated from January 1, 2026, and you won’t be able to use it for tax or financial transactions.

3. How can I check if my PAN and Aadhar are linked?

You can check the status on the Income Tax Department’s official portal under the “Link Aadhar” section.

4. Can I link PAN and Aadhar offline?

Yes, you can visit nearby PAN service centers or Aadhaar enrollment centers to complete the process offline.

5. Will my bank account be affected if PAN is not linked?

Yes, certain banking services and KYC verifications may be impacted if your PAN becomes inactive.