KCC Loan Recovery 2025: Key Updates for Farmers

With banks initiating steps for केसीसी ऋण recovery, protests and awareness campaigns are rising. Here’s what farmers should know about recovery, repayment, and legal options in 2025.

What is KCC Loan Recovery?

Kisan credit card loan recovery refers to bank actions taken when farmers default on their KCC loans. Actions may include notices, legal steps, or auctioning collateral in severe cases.

Current Scenario in 2025

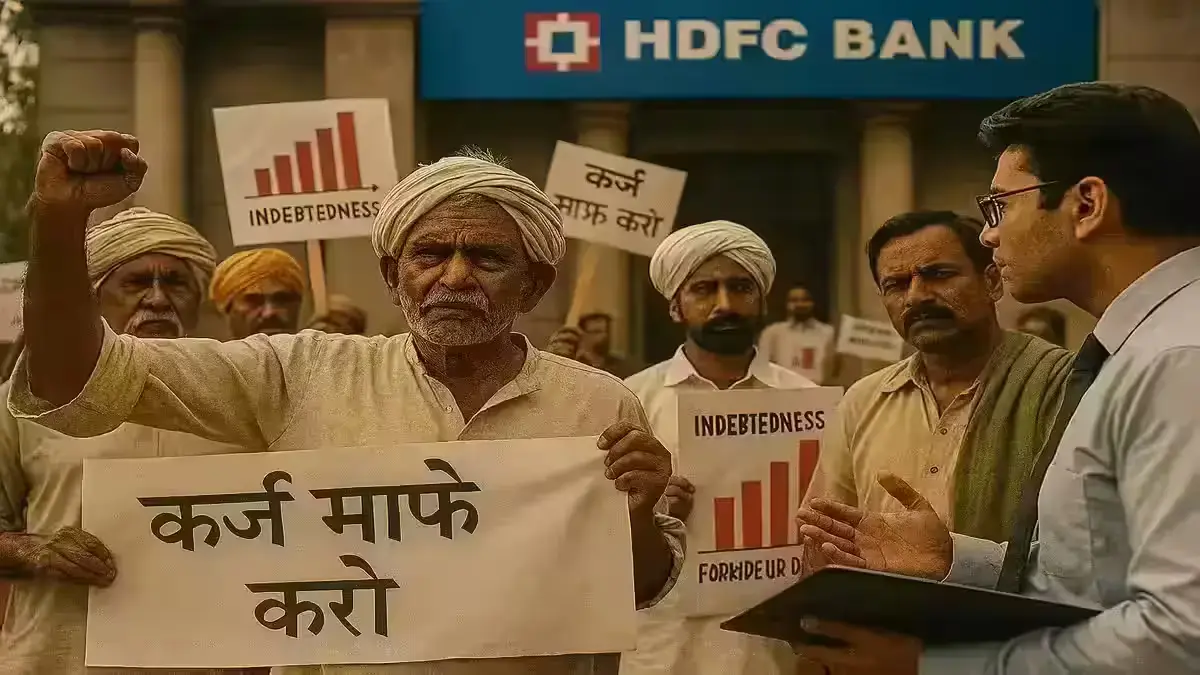

Many districts report pending repayments. In Mathura, authorities are preparing notices for defaulters, with possible auctioning of collateral if dues remain unpaid. Farmers in some areas have protested, demanding leniency and fair handling of loans.

Protests and Awareness

Organizations like Bharatiya Kisan Sangh have staged protests at banks such as HDFC, raising concerns about loan recovery policies. Farmers have also reported cases where loans were issued despite rejected KCC applications.

Comparison of Offers & Terms

KCC loans generally provide seasonal credit for crops at subsidized interest. Default penalties may increase interest rates to 13–18 % depending on bank rules. Some banks allow rescheduling or extensions to support farmers during hardship.

Legal & Institutional Process

Banks may approach Debt Recovery Tribunals (DRT) under the RDDBFI Act to recover dues. In cases where land is mortgaged, legal approval may allow the sale of collateral if repayments are not made.

Impacts on Farmers

Recovery actions can significantly impact farmers’ livelihoods, especially during poor harvests or financial stress. Awareness of repayment options and legal rights is essential to avoid losses.

Disclaimer

Information provided here is based on general news updates and official guidelines. Final actions by banks or government authorities may vary.

FAQs – KCC Loan Recovery

Q: What happens if a KCC loan is not repaid?

Banks may issue notices, take legal action, or auction collateral if repayments are not made.

Q: Can farmers protest recovery actions?

Yes, farmer organizations often organize protests to demand leniency or restructuring of loans.

Q: What interest applies to KCC defaults?

Default penalties can push interest rates to 13–18 %, depending on bank policy.

Q: Is loan rescheduling possible?

Some banks allow extensions or restructuring depending on the farmer’s situation and policy guidelines.

Q: Where can legal recovery be processed?

Banks can approach Debt Recovery Tribunals (DRT) under the RDDBFI Act to recover dues when amicable solutions fail.