High-Return Mutual Funds Delivering Over 20% CAGR in 2025

Small-cap and mid-cap mutual funds continue to draw investor interest as several schemes have delivered over 20% CAGR across 3, 5 and 10-year periods. Funds like Nippon India Small Cap and Quant Small Cap stand out for consistent performance, but investors must balance return expectations with market volatility. This update breaks down the latest trends, performance insights and what investors should know before choosing a high-growth mutual fund.

Understanding High-Return Mutual Funds

Mutual funds remain one of the most accessible ways to participate in equity markets. Among all categories, small-cap and mid-cap mutual funds have gained attention for delivering over 20% CAGR across various long-term time frames. These funds invest in emerging companies with growth potential, but they also carry higher volatility compared to large-cap schemes.

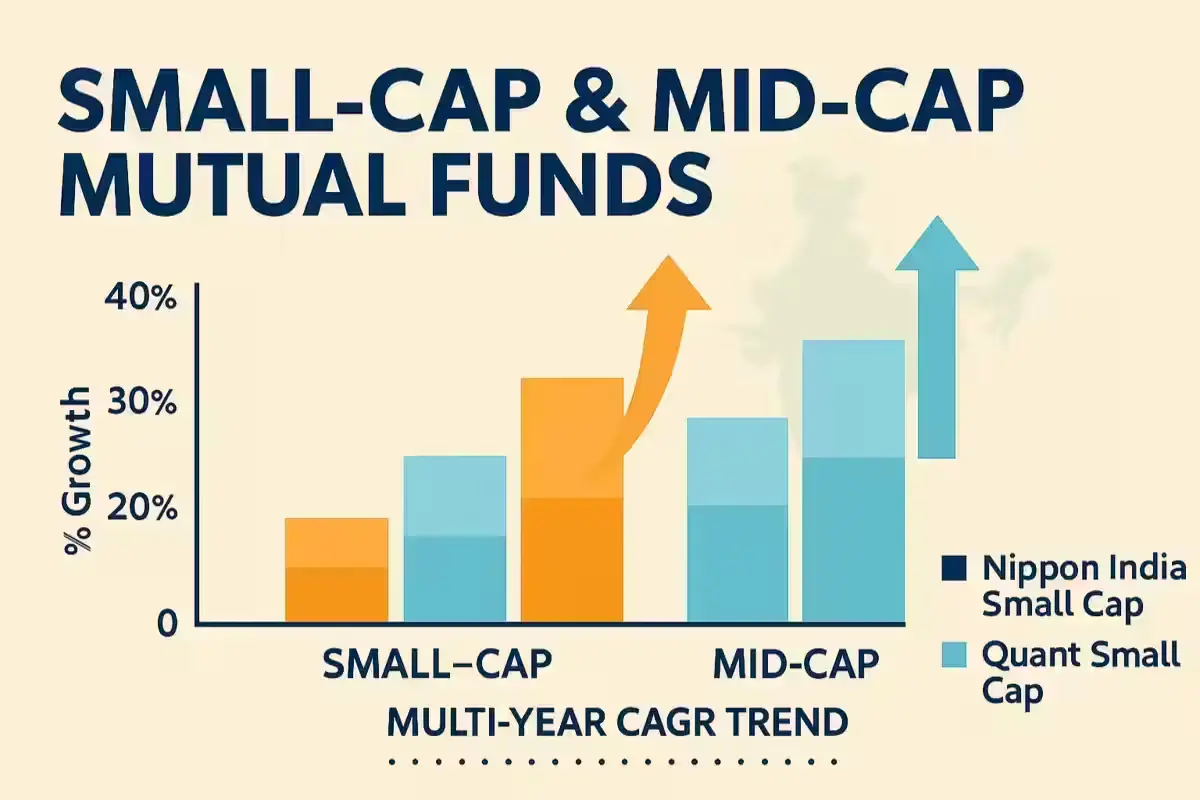

Small-Cap Mutual Funds Showing Strong Multi-Year Returns

Small-cap mutual funds tend to outperform during growth cycles, and several schemes continue to reflect strong performance across 3, 5 and 10-year periods. This includes well-known funds such as Nippon India Small Cap, Quant Small Cap, SBI Small Cap Fund, HDFC Small Cap Fund, and ICICI Prudential Small Cap Fund.

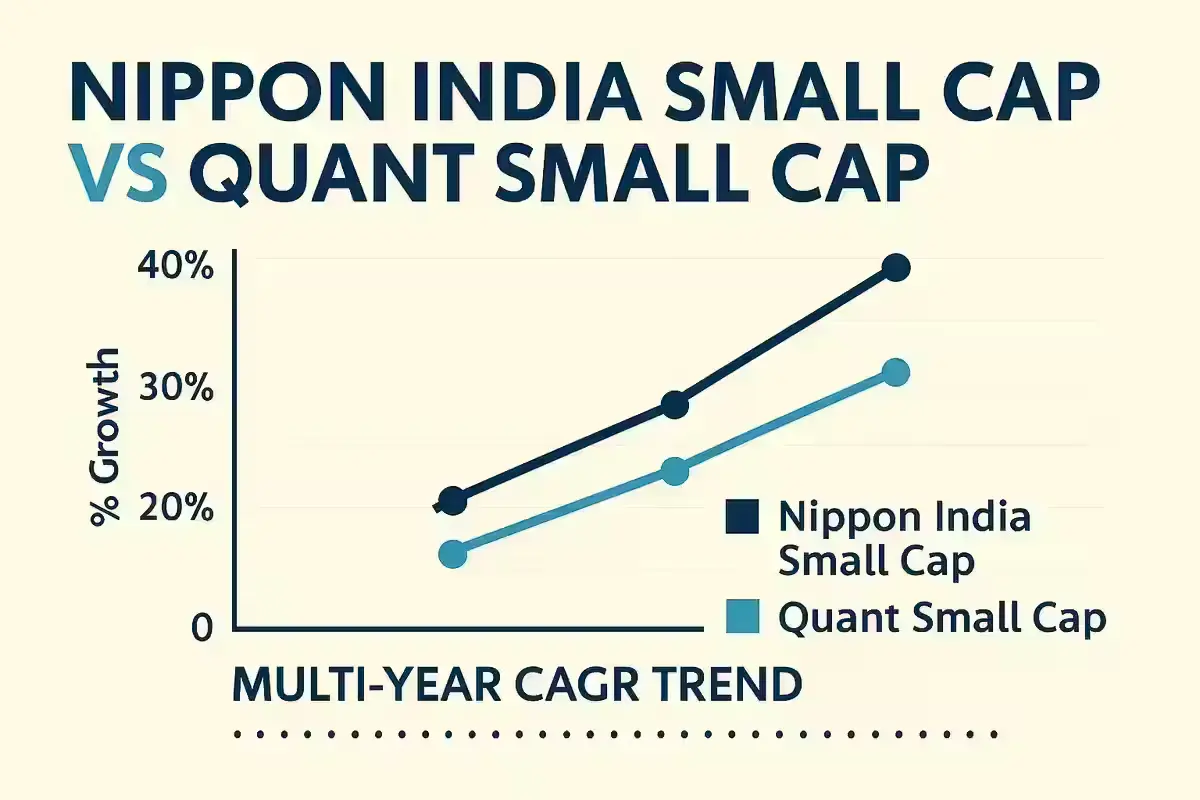

Among them, Nippon India Small Cap and Quant Small Cap often stand out due to strong inflows and consistent execution of their investment strategies. Both funds have delivered multi-year returns that continue to attract investors looking for long-term compounding opportunities.

Performance Comparison: Nipton India Small Cap vs Quant Small Cap

| Mutual Fund | Category | 3-Year Trend | 5-Year Trend | 10-Year Trend | Investment Approach |

|---|---|---|---|---|---|

| Nippon India Small Cap Fund | Small Cap | Historically above 20% CAGR | Consistent high-growth performance | Strong compounding over decade | Focus on emerging small-cap companies with sector diversification |

| Quant Small Cap Fund | Small Cap | Historically above 20% CAGR | Focused multi-year growth | Strong long-term momentum | Quant-driven approach with high-conviction stock selection |

Mid-Cap Mutual Funds Also Showing Strong Growth

Several mid-cap funds have also posted strong multi-year CAGR above 20%. Notable schemes include Axis Midcap Fund, Kotak Emerging Equity Fund, Motilal Oswal Midcap Fund, and DSP Midcap Fund. These funds invest in companies that have already established a market presence but continue to expand their business footprint.

What Investors Should Consider

High-return mutual funds can deliver strong long-term compounding, but they also come with meaningful short-term volatility. Here are key factors to review:

High-return mutual funds can deliver strong long-term compounding, but they also come with meaningful short-term volatility. Here are key factors to review:

- Risk tolerance – small caps can move sharply in either direction.

- Investment horizon – minimum 5–7 years for meaningful gains.

- SIP discipline – helps manage volatility and capture long-term returns.

- Portfolio diversification – avoid over-allocation to small caps.

- Fund manager strategy and sector allocation.

Investors should look beyond recent returns and evaluate consistency, fund philosophy, and whether the scheme aligns with future financial goals.

Disclaimer

This article provides general information for educational purposes. It is not financial advice. Investors should consult financial professionals before making investment decisions. Past performance does not guarantee future outcomes.

FAQs: High-Return Mutual Funds

1. Which mutual funds have delivered more than 20% CAGR?

Small-cap funds such as Nippon India Small Cap, Quant Small Cap, and several mid-cap schemes have delivered 20%+ CAGR over multi-year periods.

2. Are small-cap mutual funds suitable for beginners?

Small-cap funds carry higher volatility. Beginners should invest only if comfortable with long-term investing horizons and market fluctuations.

3. What makes Nippon India Small Cap and Quant Small Cap popular?

Both funds have shown consistent multi-year returns, strong stock selection, and long-term performance stability.

4. Should past returns influence my decision?

Past returns provide perspective, but they should not be the only factor. Strategy, risk level, and fund management matter equally.