Has Govt cut PPF, NSC interest rates after RBI repo rate cut of 1%?

If you’ve been following interest-rate moves, you probably noticed the Reserve Bank of India cut the repo rate by 1%. Many savers are now asking: did the government reduce PPF or NSC interest rates too? This article explains the current situation in simple language and what it means for your savings and bank accounts.

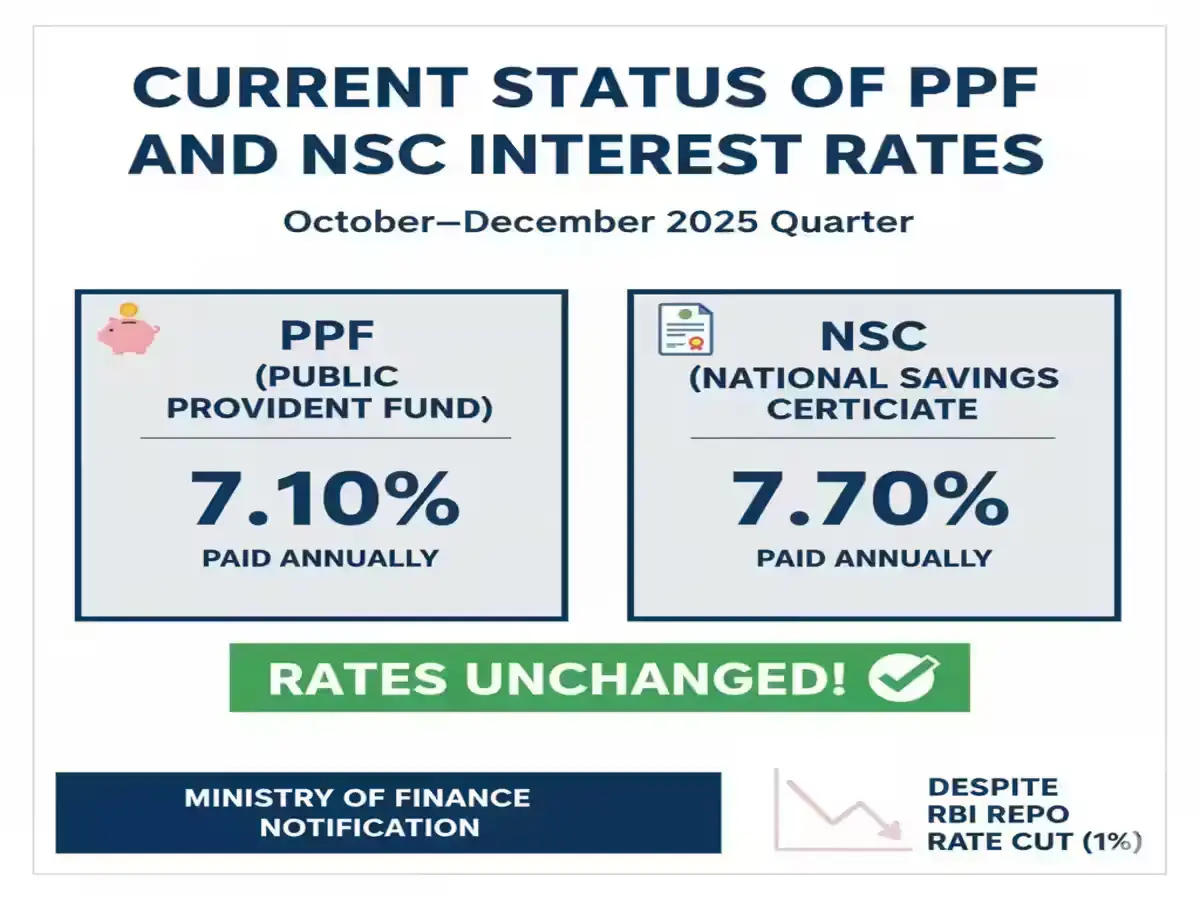

Current Status of PPF and NSC Interest Rates

The government reviews small savings schemes interest rates every quarter. For the October–December 2025 quarter, the Ministry of Finance announced that the PPF interest rate remains at 7.10% and NSC remains at 7.70%. Despite RBI’s repo rate cut of 1%, these rates are unchanged.

The government reviews small savings schemes interest rates every quarter. For the October–December 2025 quarter, the Ministry of Finance announced that the PPF interest rate remains at 7.10% and NSC remains at 7.70%. Despite RBI’s repo rate cut of 1%, these rates are unchanged.

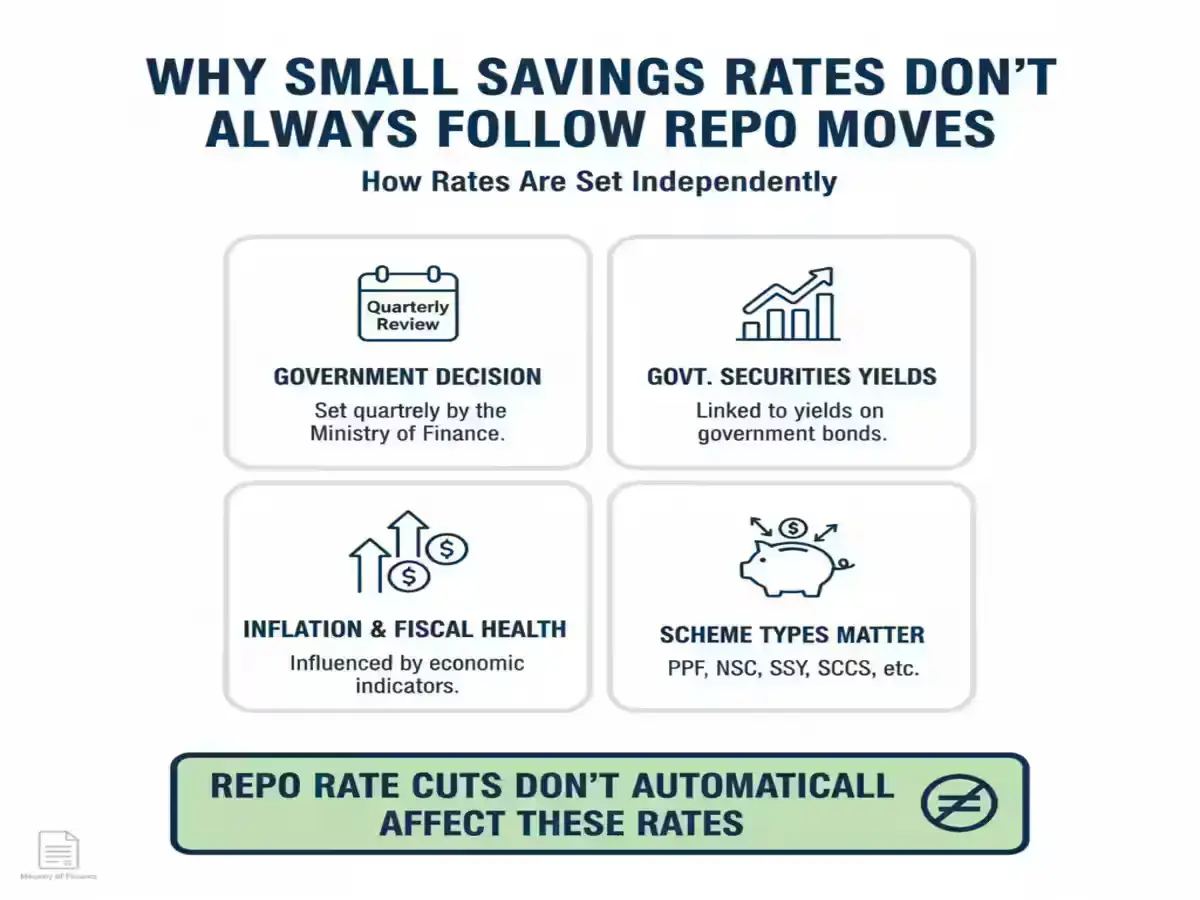

Why Small Savings Rates Don’t Always Follow Repo Moves

Interest rates for small savings schemes like PPF, NSC, Sukanya Samriddhi Yojana, and Senior Citizen Savings Scheme are set quarterly by the government. They depend on factors such as government securities yields, inflation, and fiscal considerations. Therefore, a repo rate cut does not automatically affect these rates.

Other Post Office Schemes

For the same quarter, other schemes also remain steady: Sukanya Samriddhi Yojana at 8.2%, Senior Citizen Savings Scheme at 8.3%, and Kisan Vikas Patra at 7.5% (maturing in 115 months).

Impact on Bank Accounts and FDs

Impact on Bank Accounts and FDs

While small savings schemes remain steady, banks such as Yes Bank may adjust savings account interest rates and FD rates following the repo cut. Always check official bank apps or websites for the latest updates.

Effective Dates and Live Updates

The updated small savings rates are effective from October 1, 2025, to December 31, 2025. Next quarter’s review will happen before January 2026. For live updates, rely only on official government notifications.

Disclaimer

This article is for general informational purposes only and is not financial advice. Verify rates with your bank or post office before making investment decisions.

FAQs on Interest Rates

Has Govt cut PPF interest rates of 1%?

No. PPF remains at 7.10% for the October–December 2025 quarter.

Has Govt cut NSC interest rates of 1%?

No. NSC remains at 7.70% for the same period.

Does RBI repo rate cut automatically reduce small savings rates?

No, small savings schemes are revised quarterly by the government and not directly tied to repo rate changes.

Will bank savings or FD rates change?

Possibly. Banks may adjust their savings and FD rates based on repo rate changes, but it depends on each bank’s policy.

Where can I check latest post office scheme rates?

Refer to official government notifications or visit your nearest post office for confirmed rates.

Quick Takeaways

- PPF remains at 7.10% and NSC at 7.70% despite RBI repo cut of 1%.

- Other small savings schemes also remain unchanged.

- Banks may adjust savings and FD rates, so monitor official updates.

- Next official review before January–March 2026 quarter.

Author: Banking Insights Blog – Financial writer with experience covering retail savings and policy changes.

Impact on Bank Accounts and FDs

Impact on Bank Accounts and FDs