The Employees’ Provident Fund Organisation (EPFO) manages retirement savings for millions of salaried employees across India. It operates under the Ministry of Labour and Employment and ensures social security benefits through the Employees’ Provident Fund (EPF), Employees’ Pension Scheme (EPS), and Employees’ Deposit Linked Insurance (EDLI).

What is the New Rule?

In October 2025, the EPFO announced new withdrawal guidelines aimed at improving liquidity for members while ensuring long-term financial security. These changes allow partial withdrawals up to 75% of the EPF corpus and redefine conditions for full settlement and pension eligibility. The update also introduces a longer waiting window before full withdrawal after job loss.

Extended Window for Fund Withdrawal

Under the new rules, members can now withdraw the remaining 25% of their EPF balance only after a continuous unemployment period of 12 months. Earlier, members could withdraw their full balance after just two months of leaving a job. This extension encourages members to retain funds for long-term growth and interest accumulation.

75% Withdrawal Allowed Immediately

The government has clarified that employees who leave their jobs can withdraw up to 75% of their total EPF balance immediately. This amount includes both employee and employer contributions along with accrued interest. The remaining 25% stays in the account to ensure members retain some savings in case they get re-employed within a short period.

25% Minimum Balance Requirement

A minimum of 25% of the provident fund corpus must remain in the EPF account after partial withdrawal. This change aims to safeguard members’ retirement savings and ensure that they continue to earn interest on the retained balance. The move is designed to prevent early depletion of savings and maintain financial discipline among members.

EPS Pension Rule of 36 Months

The new rules also modify the Employees’ Pension Scheme (EPS). To be eligible for pension withdrawal, members must now have a minimum of 36 months of continuous service. This adjustment helps build a more stable pension corpus and encourages longer-term participation in the scheme. The pension payout remains available once members meet the service and age criteria under EPS guidelines.

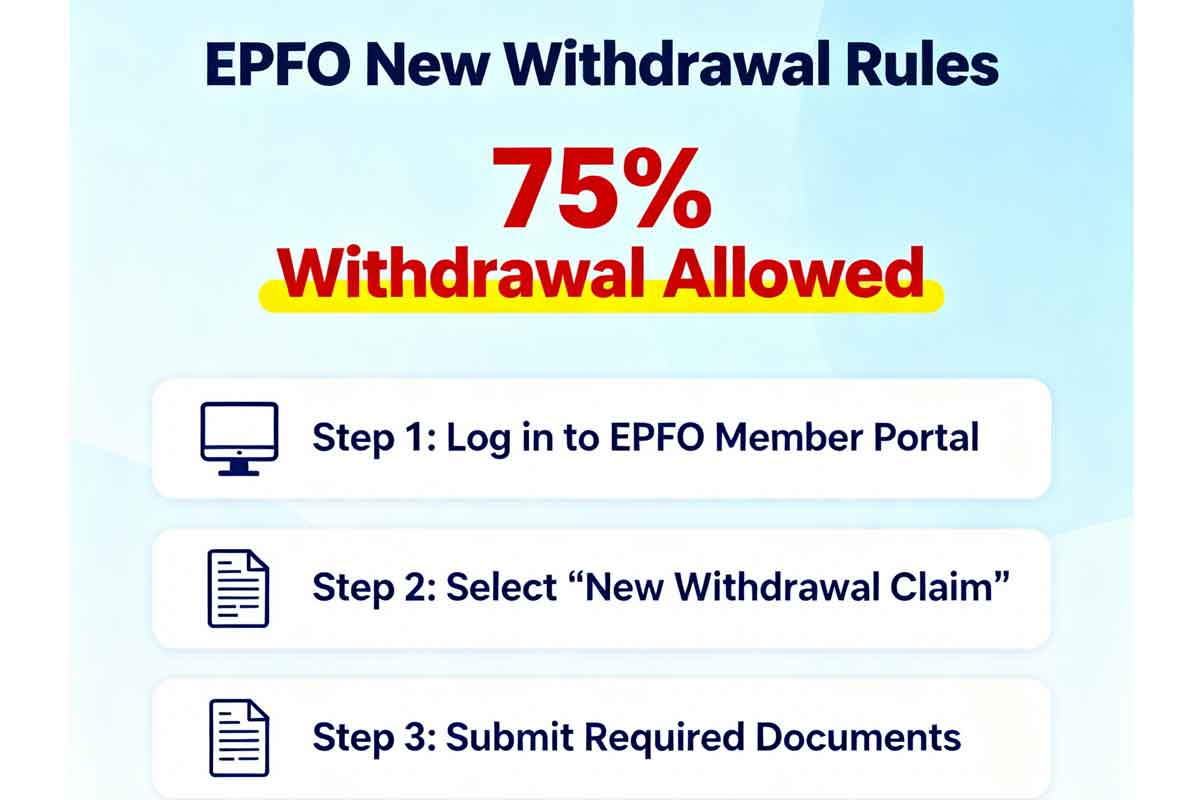

Steps to Withdraw Funds from EPFO

Members can easily withdraw funds under the new rules by following these steps:

- Ensure your UAN (Universal Account Number) is activated and KYC details are verified.

- Visit the official EPFO Member e-Seva portal (https://unifiedportal-mem.epfindia.gov.in/).

- Login with your credentials and select the “Online Services” → “Claim (Form 31, 19, 10C, 10D)” option.

- Enter the last four digits of your bank account and verify via OTP sent to your registered mobile number.

- Choose the withdrawal type — partial or full — based on eligibility.

- Submit the claim form online; once approved, the amount is credited directly to your bank account.

Why These EPFO Changes Matter

The latest EPFO changes aim to create a balance between accessibility and retirement protection. Allowing 75% immediate withdrawal helps individuals manage financial stress during unemployment or emergencies. At the same time, keeping 25% of the corpus untouched ensures a steady retirement fund and encourages members to rejoin the organized workforce without losing benefits.

Disclaimer

This article is based on the latest government circulars and media reports as of October 2025. The EPFO may release additional clarifications or updates in the coming months. Members are advised to verify the final rules through official EPFO notifications or consult a certified financial advisor before making withdrawal decisions.

FAQs

Q1. What are the EPFO new withdrawal rules introduced in 2025?

A: Members can now withdraw up to 75% of their EPF balance immediately after leaving employment, while the remaining 25% can be withdrawn after 12 months of continuous unemployment. Pension withdrawal eligibility is extended to 36 months of service.

Q2. Why did EPFO make these changes?

A: The EPFO changes were made to balance liquidity needs with long-term savings goals. The new rules provide easier access to funds while ensuring that a portion of the corpus remains protected for retirement.

Q3. How can I apply for EPF withdrawal online?

A: You can apply through the EPFO Member e-Seva portal using your UAN credentials. Select the appropriate withdrawal form (Form 31, 19, or 10C), verify your bank details, and submit the claim electronically.