Share Market Today: GIFT Nifty Up 205 Points, Will Nifty Cross 26,000 on 20 October 2025?

Buy or Sell on Diwali 2025: As markets open higher ahead of the festive week, investors look for cues in gold prices, IPO listings, and dividend announcements.

Share Market Today: Buy or Sell on Diwali 2025 – Key Trends for 20 October 2025

The stock market today opened on a positive note as GIFT Nifty surged 205 points in early trade, hinting at a strong start for Indian equities ahead of Diwali 2025. The overall market sentiment remains upbeat, with investors focusing on festive demand, global cues, and corporate results for direction.

Sensex and Nifty Outlook

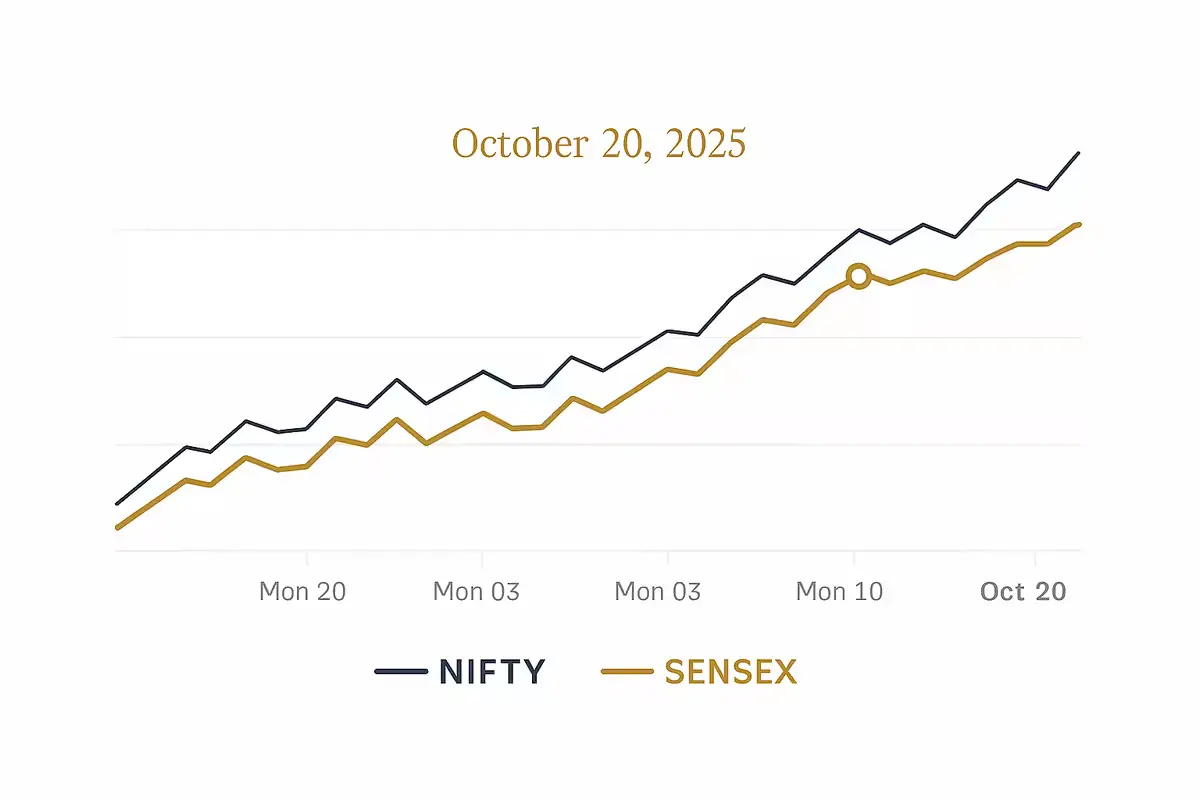

On 20 October 2025, both benchmark indices started higher, tracking gains from Asian markets. The BSE Sensex opened above 85,000, while the Nifty 50 tested the crucial 26,000 mark. Analysts believe that if Nifty sustains above 25,850, we may see further momentum leading into the Diwali week.

Gold Prices Drop Ahead of Diwali

Interestingly, while equities are shining, gold prices in India have dropped slightly compared to the previous week. The decline in gold may indicate a shift in investor sentiment toward equities, especially with festive optimism and positive corporate earnings lifting the market mood.

Buy or Sell on Diwali 2025?

Market experts suggest a selective approach this Diwali. Traders are advised to look for fundamentally strong companies rather than chasing short-term rallies. Stocks in sectors like banking, auto, and FMCG are showing resilience. Some analysts have recommended three stocks for accumulation this week, expecting potential upside in the near term.

Dividend, Bonus & Multibagger Updates

Investors are also watching out for dividend and bonus announcements from major companies. Several midcap stocks have already delivered strong returns this year, and experts say a few could turn into multibaggers if held with a medium-term perspective.

IPO and GMP Buzz

The primary market remains active with new IPO listings scheduled around Diwali. Grey Market Premiums (GMPs) for upcoming issues show steady interest, especially in small and mid-cap offerings. Investors should, however, check fundamentals before subscribing.

Subscription, Lot Size & Issue Dates

Retail investors are closely tracking IPO subscription levels and lot sizes. Most new issues have received strong retail participation so far, signaling healthy sentiment in the broader market. Issue dates around Diwali are expected to attract good demand due to positive liquidity conditions.

Market Base Price & Technical View

The base price for Nifty is seen near 25,600, with resistance around 26,050. A break above this level could open the path toward new highs. Traders should maintain stop-loss levels and follow a disciplined approach amid festive volatility.

Live Market Sentiment

Overall, the share market today reflects optimism as investors gear up for Diwali trading. Broader indices are firm, smallcaps are active, and FIIs are showing renewed buying interest. Whether you choose to buy or sell on Diwali 2025, market discipline remains key.

Muhurat Trading Timing (Diwali 2025)

For Diwali (Samvat 2082), exchanges will conduct a special Muhurat Trading session, a one-hour symbolic trading window observed every year. The timings for Muhurat Trading 2025 are scheduled as follows:

- Date: Tuesday, 21 October 2025

- Session Start: 01:45 PM IST

- Session End: 02:45 PM IST

- Trade Modification Cut-off: 02:55 PM IST (for settlements/confirmations)

Note: On this day regular trading remains closed and only the special Muhurat session will be conducted. The session follows a pre-open procedure and may include a brief block deal window as per exchange circulars. Investors participating in Muhurat trading should be aware that trades executed during this session are binding and will result in settlement obligations.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. Investors are advised to consult a certified financial advisor before making any trading or investment decisions.

FAQs: Share Market Today – 20 October 2025

1. Why is GIFT Nifty up 205 points today?

GIFT Nifty rose due to strong global cues and festive optimism in the domestic market ahead of Diwali 2025.

2. Should I buy or sell stocks before Diwali 2025?

Experts recommend holding quality stocks with strong fundamentals. Avoid speculative trading during high volatility.

3. What are the key resistance levels for Nifty today?

The Nifty 50 is facing resistance near 26,050 and support around 25,600.

4. Are gold prices affecting stock sentiment?

Yes, a slight drop in gold prices is driving more investor attention toward equities.

5. Which sectors look promising this Diwali?

Banking, auto, FMCG, and select midcaps are expected to perform well during the festive period.