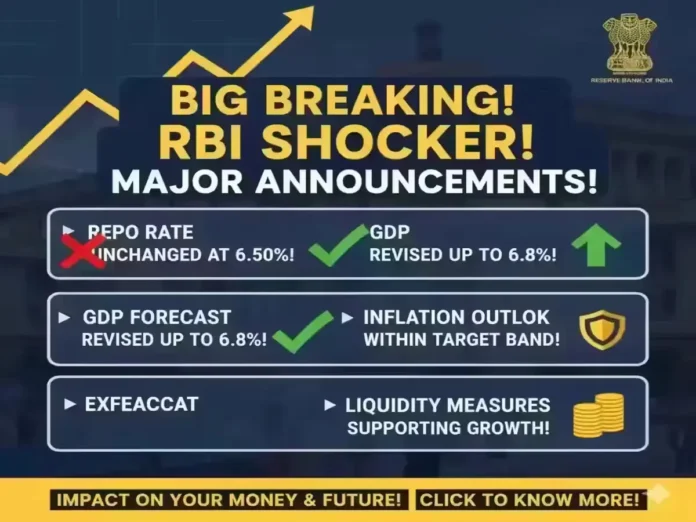

RBI Monetary Policy October 2025: Repo Rate Unchanged, Growth Outlook Raised

The Reserve Bank of India (RBI) announced its monetary policy on 1 October 2025 after the latest MPC meeting. The central bank decided to keep the repo rate unchanged at 6.50%. While interest rates remain steady, the RBI revised India’s GDP growth forecast for 2025-26 to 6.8%, signaling optimism about the economy despite global trade uncertainties.

Quick Reference – RBI Monetary Policy October 2025

| Key Parameter | Details |

|---|---|

| Repo Rate Today | 6.50% |

| GDP Growth Forecast (2025-26) | 6.8% |

| Inflation Outlook | Expected within RBI target band |

| Liquidity Measures | Continued support for growth & stability |

| RBI Policy Date | 1 October 2025 |

| Next MPC Meeting | December 2025 |

| RBI Governor | Sanjay Malhotra |

About the RBI Monetary Policy

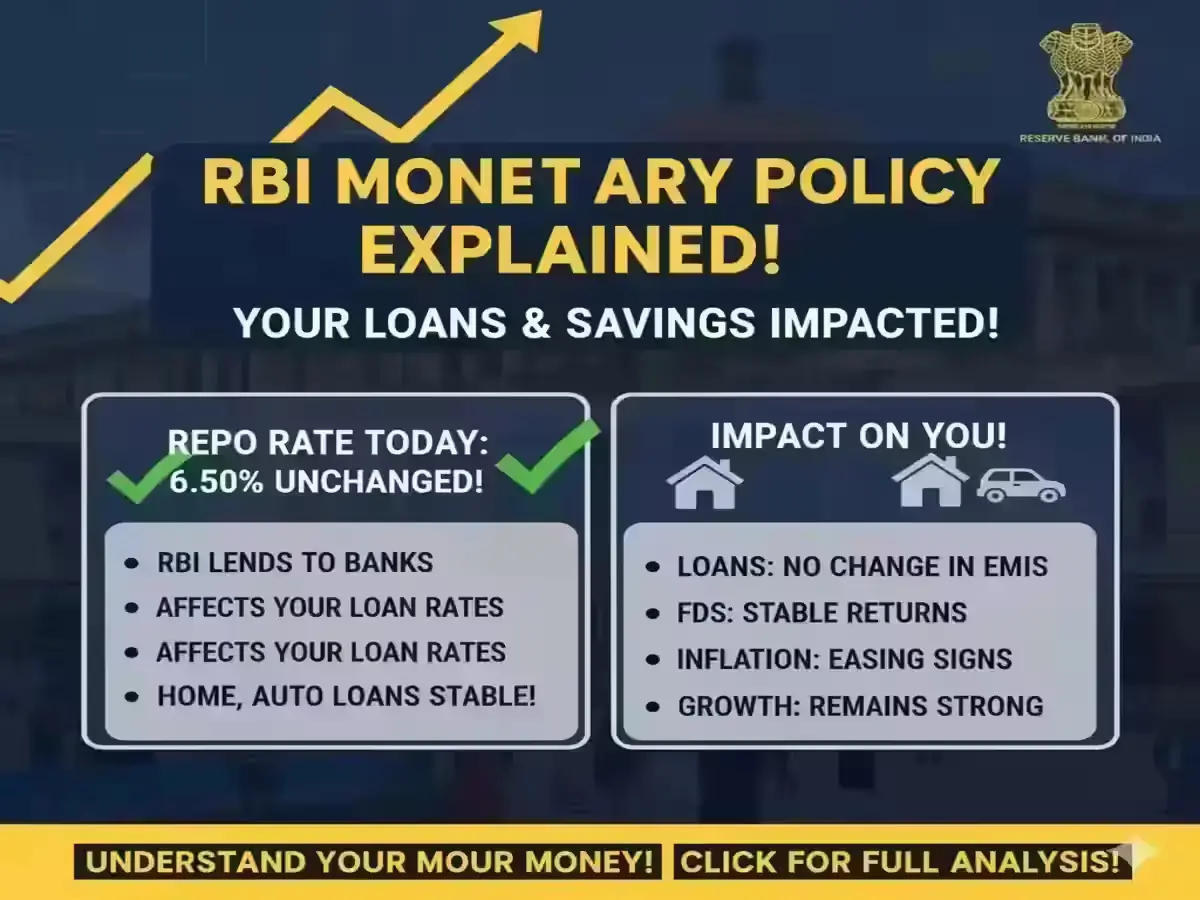

The RBI monetary policy is reviewed every two months through the Monetary Policy Committee (MPC) meeting. The repo rate, which is the rate at which RBI lends money to commercial banks, plays a crucial role in determining borrowing costs for individuals and businesses. The decision to maintain the repo rate was largely expected by market participants as inflation has shown signs of easing while growth remains resilient.

The RBI monetary policy is reviewed every two months through the Monetary Policy Committee (MPC) meeting. The repo rate, which is the rate at which RBI lends money to commercial banks, plays a crucial role in determining borrowing costs for individuals and businesses. The decision to maintain the repo rate was largely expected by market participants as inflation has shown signs of easing while growth remains resilient.

Repo Rate Today

As of October 2025, the repo rate today stands at 6.50%. This means that loans such as home loans, auto loans, and business borrowings are likely to continue at existing interest levels. For depositors, fixed deposit rates are also expected to remain stable.

Key Announcements from RBI MPC Meeting

- Repo Rate: Unchanged at 6.50%

- GDP Forecast: Revised upwards to 6.8% for FY 2025-26

- Inflation Outlook: RBI expects inflation to remain within the target band

- Liquidity Measures: RBI will continue to manage liquidity to support growth and financial stability

Impact on Borrowers and Investors

For borrowers, the unchanged repo rate means that EMIs on home loans, auto loans, and personal loans will not increase for now. For investors, the steady rate indicates a stable bond yield environment. Stock market participants viewed the decision positively, as the RBI maintained its growth-oriented stance without tightening policy further.

RBI Governor’s Statement

RBI Governor Sanjay Malhotra highlighted that while global risks remain due to trade tensions and uncertain commodity prices, India’s domestic economy continues to show resilience. He also added that the RBI remains committed to supporting growth while keeping inflation under control.

Comparison With Previous Policy

In the last MPC meeting, the repo rate was also kept unchanged. By maintaining consistency, the RBI is ensuring policy stability while monitoring the impact of external headwinds like trade tariffs and currency fluctuations.

RBI Policy Date and Live Updates

The latest RBI policy date was 1 October 2025. The next MPC meeting is scheduled for December 2025. Live updates of RBI policy are closely tracked by investors, banks, and borrowers because they directly influence market interest rates, lending activity, and financial planning.

Disclaimer

This article is for informational purposes only. Readers should refer to the official RBI notification for exact details and consult their financial advisor before making investment or borrowing decisions.

FAQs on RBI Monetary Policy Repo Rate

Q1. What is the repo rate today?

The repo rate today stands at 6.50% as per the October 2025 RBI policy.

Q2. When was the latest RBI MPC meeting held?

The latest RBI MPC meeting was held on 1 October 2025.

Q3. Did RBI announce any rate cut?

No, the RBI did not announce a rate cut. The repo rate was kept unchanged.

Q4. What is the GDP growth forecast given by RBI?

The RBI has revised India’s GDP growth forecast for FY 2025-26 to 6.8%.

Q5. How does repo rate impact borrowers?

An unchanged repo rate means EMIs on home loans and personal loans remain stable for now.