Kotak Bank Share Price Update: Kotak Mahindra Bank’s Q2 FY26 PAT slips 3% amid rising provisions. Investors eye buyback and dividend update as the stock reacts post-results.

Kotak Bank Share Price: Q2 PAT Slips 3%, Dividend & Buyback Update, Market Outlook

About Kotak Mahindra Bank

Kotak Mahindra Bank, one of India’s leading private sector lenders, reported a modest decline in its consolidated net profit for the second quarter of FY26. Known for its strong retail and corporate banking base, the bank continues to play a crucial role in India’s financial sector, catering to millions of customers through its extensive network and digital channels.

Kotak Bank Share Price Overview

The Kotak Bank share price has seen mixed performance following the Q2 results. The stock currently trades around ₹1,740 per share on the NSE, reflecting cautious investor sentiment amid profit pressure. However, analysts believe long-term fundamentals remain strong given the bank’s solid capital adequacy and low non-performing assets (NPAs).

- Current Price: ₹1,740 (approx.)

- Market Cap: ₹3.45 lakh crore

- 52-Week Range: ₹1,610 – ₹1,965

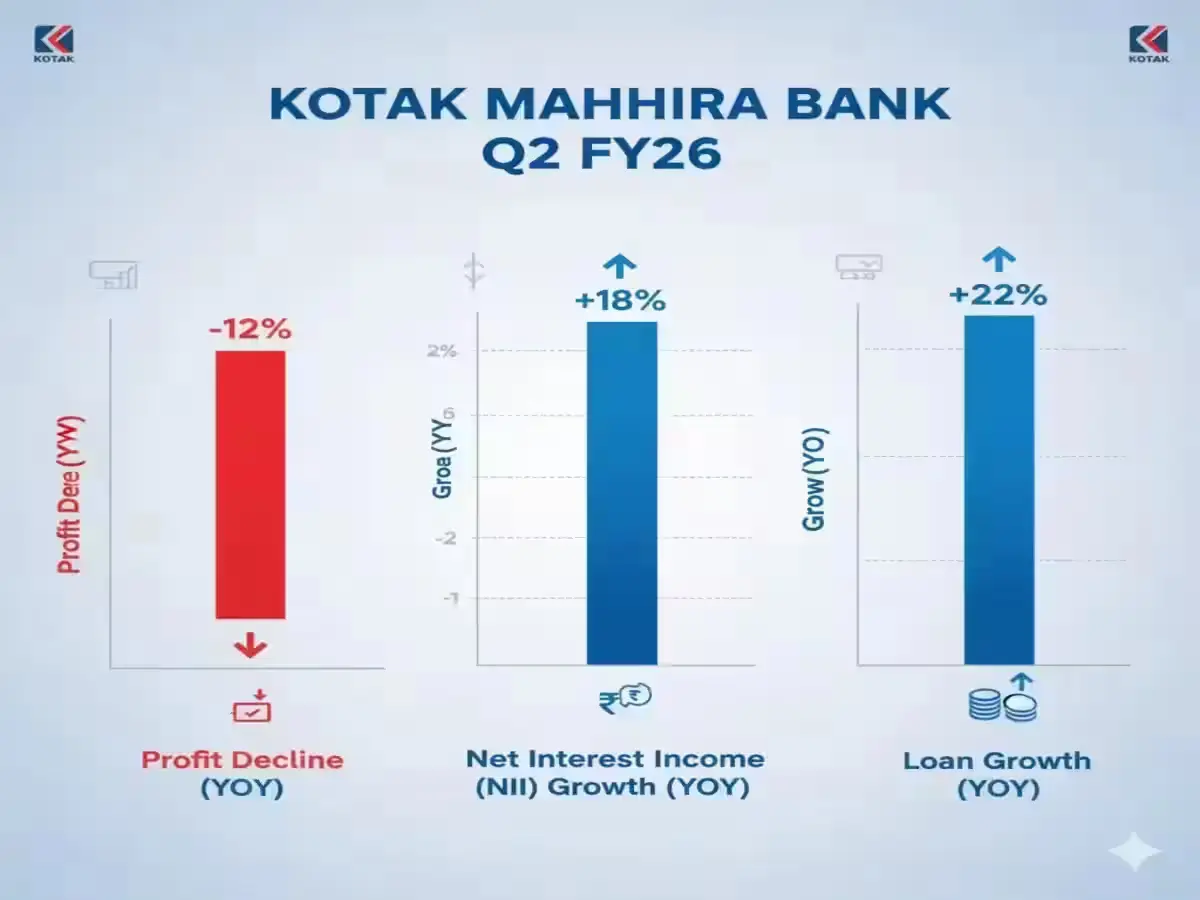

Q2 FY26 Performance Highlights

According to the latest filings, Kotak Mahindra Bank Q2 PAT slipped 3% to ₹3,253 crore from ₹3,355 crore in the same quarter last year. The dip was largely due to higher provisioning and write-offs. Net Interest Income (NII) rose marginally, while asset quality remained stable with a gross NPA ratio of 1.4%.

Key Numbers:

- Net Profit (PAT): ₹3,253 crore (down 3%)

- Provisions: ₹847 crore (up 9%)

- NII Growth: +7% YoY

- Loan Book Growth: +12% YoY

Dividend and Buyback Update

Investors are closely watching for a Kotak Mahindra Bank dividend update as the board considers its payout policy for FY26. While no official buyback announcement has been made yet, market speculation suggests the bank could explore a modest buyback to reward shareholders later in the fiscal year.

Listing and Corporate Events

Kotak Mahindra Bank has been listed on both the NSE and BSE since 1995. Over the years, the stock has delivered steady returns, often outperforming sector peers during bull phases. Recent updates on quarterly results, dividend decisions, and RBI policy changes continue to influence share price movements.

Is Kotak Mahindra a Multibagger Stock?

Analysts often label Kotak Mahindra Bank as a potential multibagger for long-term investors due to its consistent performance, prudent lending policies, and strong management under Uday Kotak. The bank’s conservative risk approach and focus on digital expansion make it a reliable play in the private banking space.

Market Sentiment & Analyst View

Brokerages maintain a “Hold” to “Buy” rating on Kotak Bank shares, citing near-term earnings pressure but long-term growth potential. The Q2 dip is viewed as temporary, with improving margins expected in FY27 once credit costs stabilize.

- Analyst Target Price: ₹1,900 – ₹2,000

- Investment View: Accumulate on Dips

Disclaimer

This article is for informational purposes only and should not be construed as financial advice. Investors are advised to conduct their own research or consult a qualified financial advisor before making investment decisions.

FAQs

Q1: What is the current Kotak Bank share price?

The current Kotak Bank share price is around ₹1,740 per share on the NSE, as of the latest trading session.

Q2: Why did Kotak Mahindra Bank’s Q2 profit decline?

The bank’s Q2 FY26 profit declined by 3% mainly due to higher provisioning and write-offs, despite steady loan growth and stable asset quality.

Q3: Has Kotak Mahindra Bank announced any dividend or buyback?

As of now, no official buyback or dividend announcement has been made for FY26, though investors expect updates in the upcoming board meeting.

Q4: Is Kotak Mahindra Bank a good long-term investment?

Yes, Kotak Mahindra Bank is considered a fundamentally strong stock with steady growth, making it a preferred choice for long-term investors seeking stability.