Key Updates – Jinkushal Industries IPO

- Allotment: IPO allotment to conclude Tuesday; listing on October 3

- GMP: Steady in unlisted market, reflecting strong order book

- Subscription: 65x overall; retail 47x, NIIs 146x, QIBs 36x

- Sector: Construction machinery exports across 30+ countries

- Comparison: Jinkushal vs Trualt Bioenergy IPOs – high investor appetite

Jinkushal Industries IPO GMP Today: Allotment, Stock Price & Listing Updates

Jinkushal Industries, an export-oriented construction machinery firm, is wrapping up its IPO allotment after strong investor demand. The issue, totaling Rs 116 crore, attracted bids over 65 times the shares on offer, highlighting intense interest from retail and institutional investors alike.

IPO Allotment & Subscription

Retail investors bid 47 times their quota, while Non-Institutional Investors (NIIs) went as high as 146 times their reserved portion. Qualified Institutional Buyers (QIBs) contributed nearly 36 times their allocation. Investors can now check their allotment status through the registrar Bigshare Services or the BSE IPO allotment page.

About Jinkushal Industries

Founded in 2007, Jinkushal Industries specializes in exporting new, customized, and refurbished construction machinery to more than 30 countries, including the UAE, Mexico, Netherlands, and the UK. The company has also introduced its HexL brand of backhoe loaders in partnership with a Chinese venture.

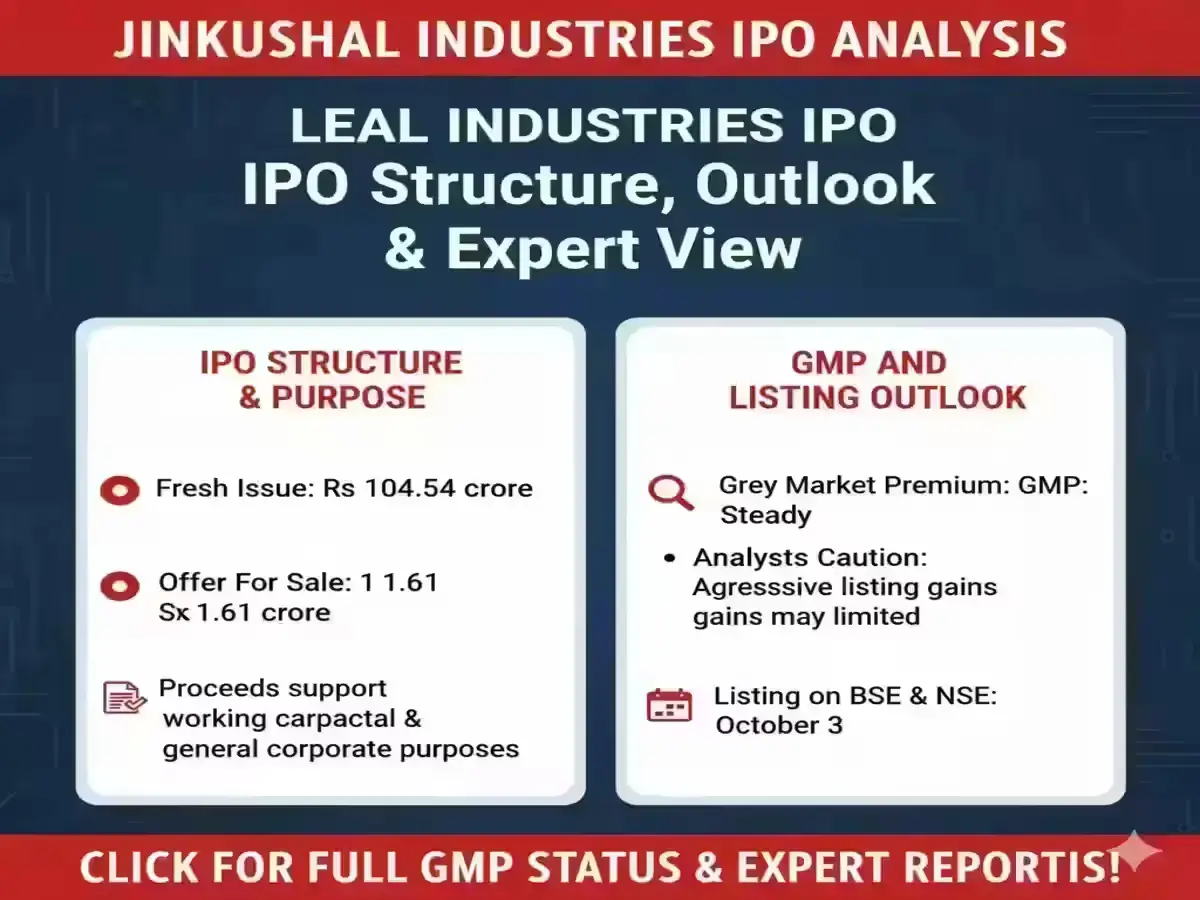

IPO Structure & Purpose

IPO Structure & Purpose

The IPO comprised a fresh issue of Rs 104.54 crore and an offer for sale of Rs 11.61 crore by existing shareholders. Proceeds will primarily support working capital needs, with the remainder allocated for general corporate purposes.

GMP and Listing Outlook

The grey market premium (GMP) is steady, reflecting the company’s strong fundamentals but also indicating that the stock is “fully priced.” Analysts caution that aggressive listing gains may be limited despite high subscription numbers. Shares are set to list on the BSE and NSE on October 3.

Disclaimer: This article is for informational purposes only. It does not constitute financial advice. Investors should consult official sources before making investment decisions.

FAQ – Jinkushal Industries IPO

The IPO allotment concludes Tuesday, and shares are expected to list on October 3. Investors can check their status via Bigshare Services or BSE’s IPO page.

The grey market premium is steady, reflecting strong fundamentals but limited scope for aggressive listing gains.

Both IPOs attracted high investor interest, but Jinkushal Industries shows a strong global machinery order book and solid subscription numbers, similar to Trualt Bioenergy.

Retail investors subscribed 47 times their quota, indicating strong demand and interest in the IPO.