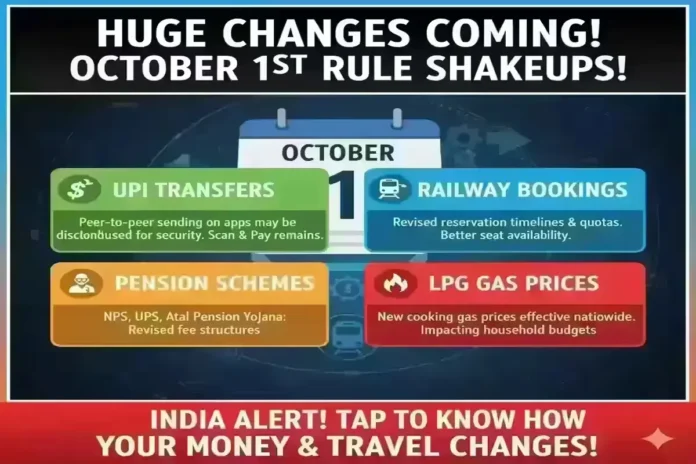

- What changes from October 1? — New rules for UPI, pensions, railway bookings, and LPG prices take effect.

- Which pension schemes are affected? — NPS, UPS, Atal Pension Yojana, and NPS Lite will see revised fee structures.

- What’s changing in UPI? — Peer-to-peer UPI transactions are likely to be discontinued to improve security.

UPI to Pensions: Several Rules Set to be Changed from October 1

With the start of October, important updates will come into effect across multiple sectors. From UPI transactions to pension rules, and from railway bookings to LPG prices, these changes are expected to directly influence daily life for many citizens. Staying informed about these updates is essential to avoid last-minute surprises.

What happened?

The government and regulatory bodies have scheduled new rules beginning October 1, 2025. These cover financial services, transport, and fuel pricing. The changes touch areas like retirement savings, digital payments, and household budgets, reflecting a wider focus on regulatory adjustments for the new quarter.

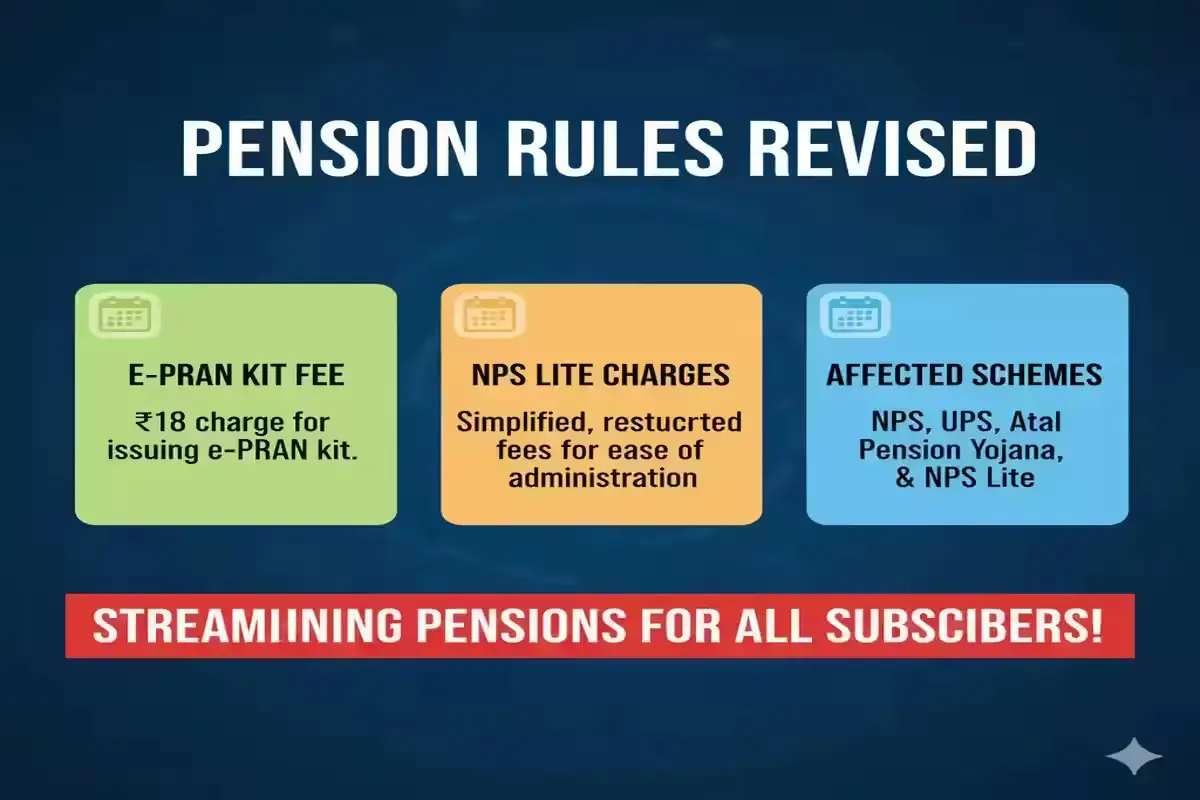

Pension rules revised

The Pension Fund Regulatory and Development Authority (PFRDA) has announced updates to schemes like NPS, UPS, Atal Pension Yojana, and NPS Lite. The fee for issuing an e-PRAN kit has been set at ₹18, while charges under NPS Lite are being restructured for simplicity. These steps aim to streamline administration for government employees and private subscribers.

The Pension Fund Regulatory and Development Authority (PFRDA) has announced updates to schemes like NPS, UPS, Atal Pension Yojana, and NPS Lite. The fee for issuing an e-PRAN kit has been set at ₹18, while charges under NPS Lite are being restructured for simplicity. These steps aim to streamline administration for government employees and private subscribers.

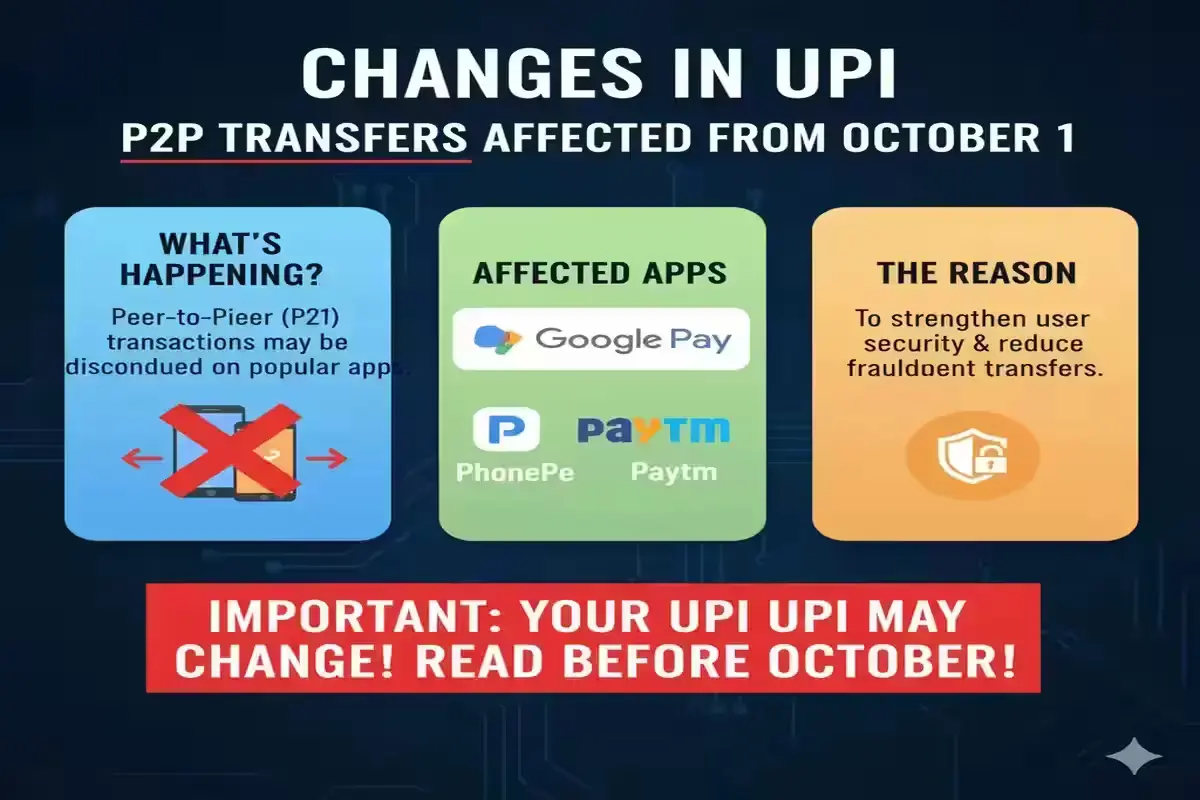

Changes in UPI

The Unified Payments Interface (UPI), widely used for peer-to-peer transfers, is undergoing adjustments. From October, P2P transactions may no longer be supported on leading apps such as Google Pay, PhonePe, and Paytm. The decision is reportedly linked to strengthening user security and reducing risks of fraudulent transfers.

The Unified Payments Interface (UPI), widely used for peer-to-peer transfers, is undergoing adjustments. From October, P2P transactions may no longer be supported on leading apps such as Google Pay, PhonePe, and Paytm. The decision is reportedly linked to strengthening user security and reducing risks of fraudulent transfers.

Railway bookings

Passengers should also note updates in railway booking rules. Indian Railways has revised its advance reservation system. Tatkal and other quota bookings are being adjusted to improve availability and reduce misuse. These changes could affect travelers who rely on last-minute tickets, so advance planning becomes more important from October 1.

Passengers should also note updates in railway booking rules. Indian Railways has revised its advance reservation system. Tatkal and other quota bookings are being adjusted to improve availability and reduce misuse. These changes could affect travelers who rely on last-minute tickets, so advance planning becomes more important from October 1.

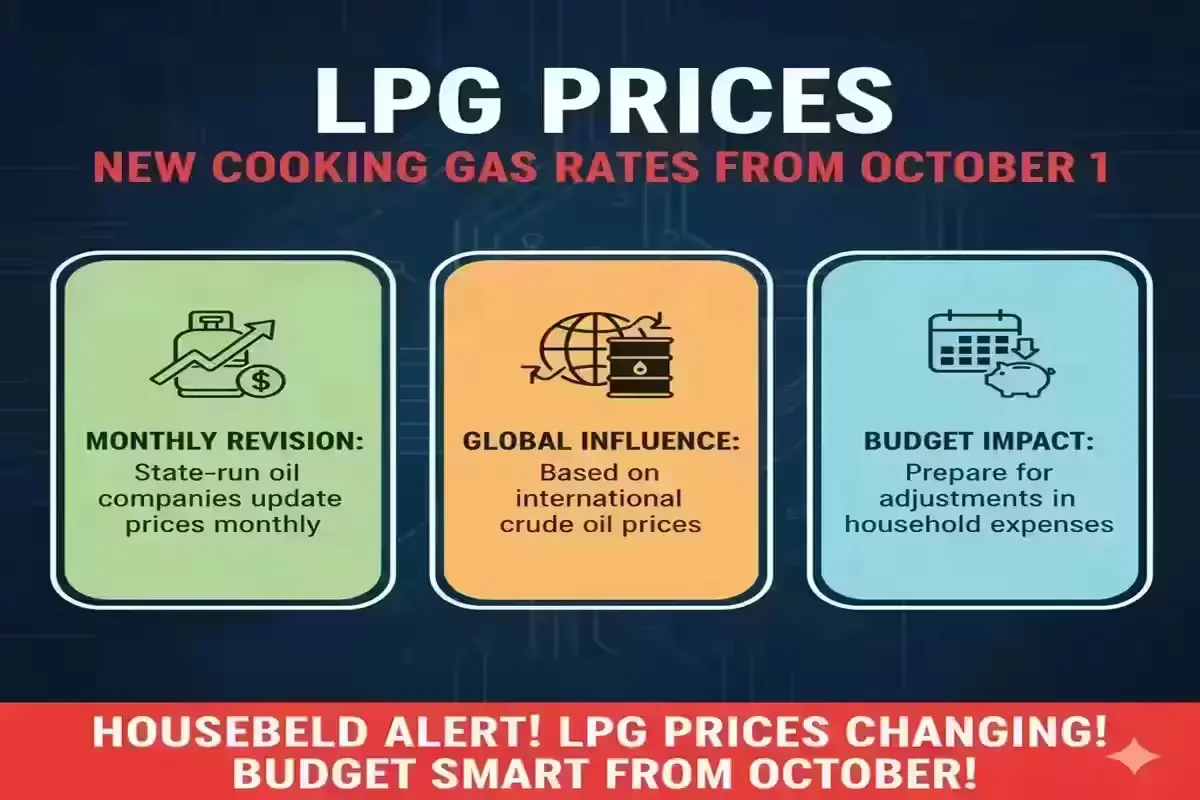

LPG prices

Households will see new LPG cylinder prices from October. State-run oil companies revise cooking gas rates at the beginning of each month, and fluctuations are based on global crude oil prices. Consumers should prepare for adjustments in their monthly budgets as LPG is a key household expense.

Households will see new LPG cylinder prices from October. State-run oil companies revise cooking gas rates at the beginning of each month, and fluctuations are based on global crude oil prices. Consumers should prepare for adjustments in their monthly budgets as LPG is a key household expense.

Impact on daily life

All these changes combined—whether related to pensions, UPI payments, railway bookings, or LPG prices—will have a real effect on citizens. Salaried employees and retirees will need to track their pension accounts more closely. Regular UPI users may need to explore alternative payment methods. Travelers should plan their rail journeys in advance, while households must account for revised LPG prices.

Disclaimer

This article is for informational purposes only. Official government circulars and announcements should be consulted for exact details and compliance requirements.