FPIs Withdraw ₹12,257 Crore: What It Means for Investors

Foreign Portfolio Investors, or FPIs, have once again turned cautious. In the very first week of September, Foreign Portfolio Investors withdrew ₹12,257 crore from Indian equities. For investors like us, this raises an important question—why now, and what comes next?

About FPIs and Their Role

FPIs are global investors who buy into Indian shares, bonds, or other market instruments. They don’t own companies directly but influence flows in and out of our market. When FPIs withdraw, liquidity shrinks, and you often see volatility in stock prices. On the other hand, steady inflows from FPIs usually support valuations.

Market Reaction and Stock Levels

The base price of several frontline stocks dipped slightly as FPIs pulled out, especially in financials and IT counters. This exit does not mean every sector is in trouble. Domestic inflows from mutual funds are cushioning the impact. Still, traders notice that when FPIs step back, index movements become choppier.

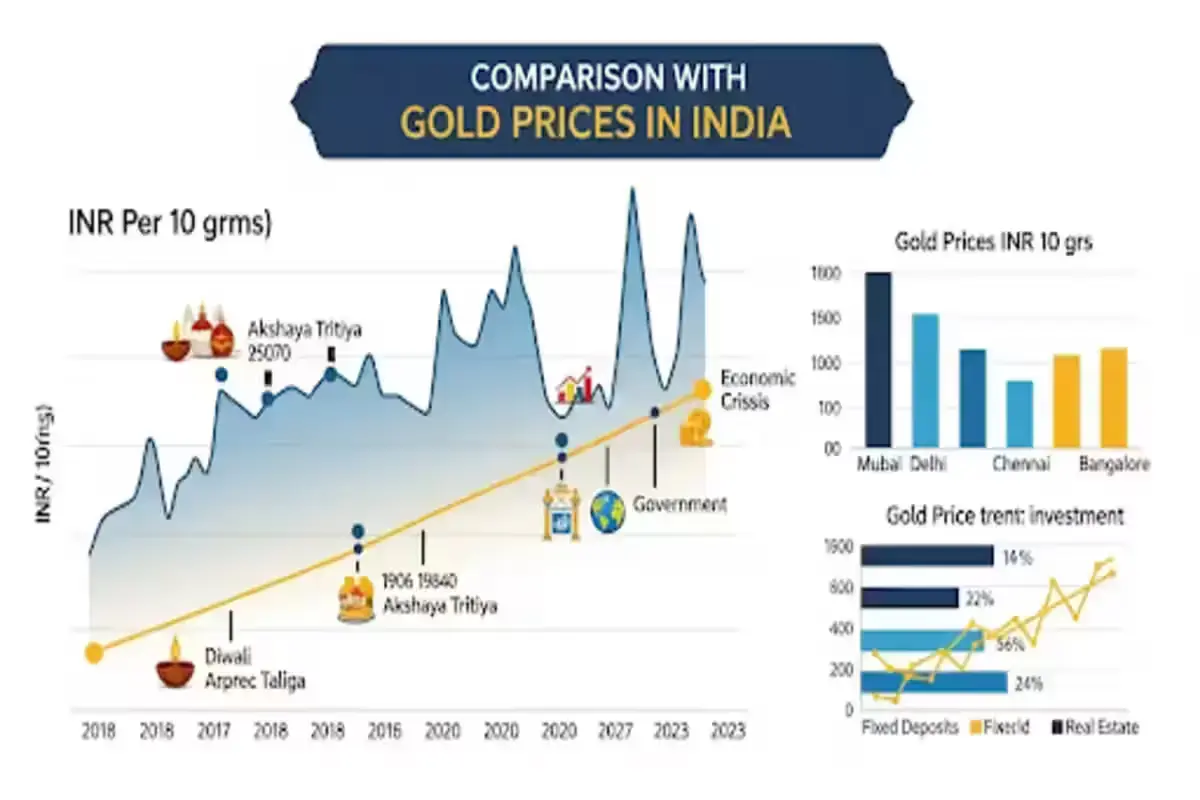

Comparison with Gold Prices in India

Interestingly, this outflow came at a time when gold prices in India dropped. Normally, foreign investors tend to treat gold as a hedge. A drop in gold alongside equity withdrawals suggests global investors are shifting capital to other regions or sitting in cash, waiting for clarity on interest rates and growth numbers.

Interestingly, this outflow came at a time when gold prices in India dropped. Normally, foreign investors tend to treat gold as a hedge. A drop in gold alongside equity withdrawals suggests global investors are shifting capital to other regions or sitting in cash, waiting for clarity on interest rates and growth numbers.

Dividends, Bonus and Multibagger Hopes

For long-term holders, FPI activity does not change the fundamentals of dividend-paying companies. If you’re holding a stock for its dividend or expecting a bonus issue, those plans remain intact. For multibagger seekers, short-term FPI exits might even present entry points if the core story is strong.

IPO Market and Subscription Buzz

The IPO market is also being watched closely. Investors keep an eye on GMP (grey market premium), lot size, and subscription trends. If FPIs stay away from new issues, domestic investors may dominate subscriptions. The issue date of upcoming IPOs could decide sentiment as much as these withdrawals do.

The IPO market is also being watched closely. Investors keep an eye on GMP (grey market premium), lot size, and subscription trends. If FPIs stay away from new issues, domestic investors may dominate subscriptions. The issue date of upcoming IPOs could decide sentiment as much as these withdrawals do.

Live View: Early September Flow

Right now, the number is ₹12,257 crore pulled out. That’s a live figure for just the first week of September, which means more movement could follow. Investors should track whether this continues across the rest of the month or if flows stabilize.

Disclaimer

This article is a simple discussion about FPIs and stock market trends. It should not be taken as financial advice. Investors are encouraged to do their own research or consult an advisor before making investment decisions.

Final Takeaway

So, FPIs have stepped back at the start of September. But like watching a market chart, it’s about trends, not one point. If you’re invested for dividends, bonuses, or waiting for the next IPO subscription, focus on your time horizon. For traders, short-term volatility is expected until these flows settle.