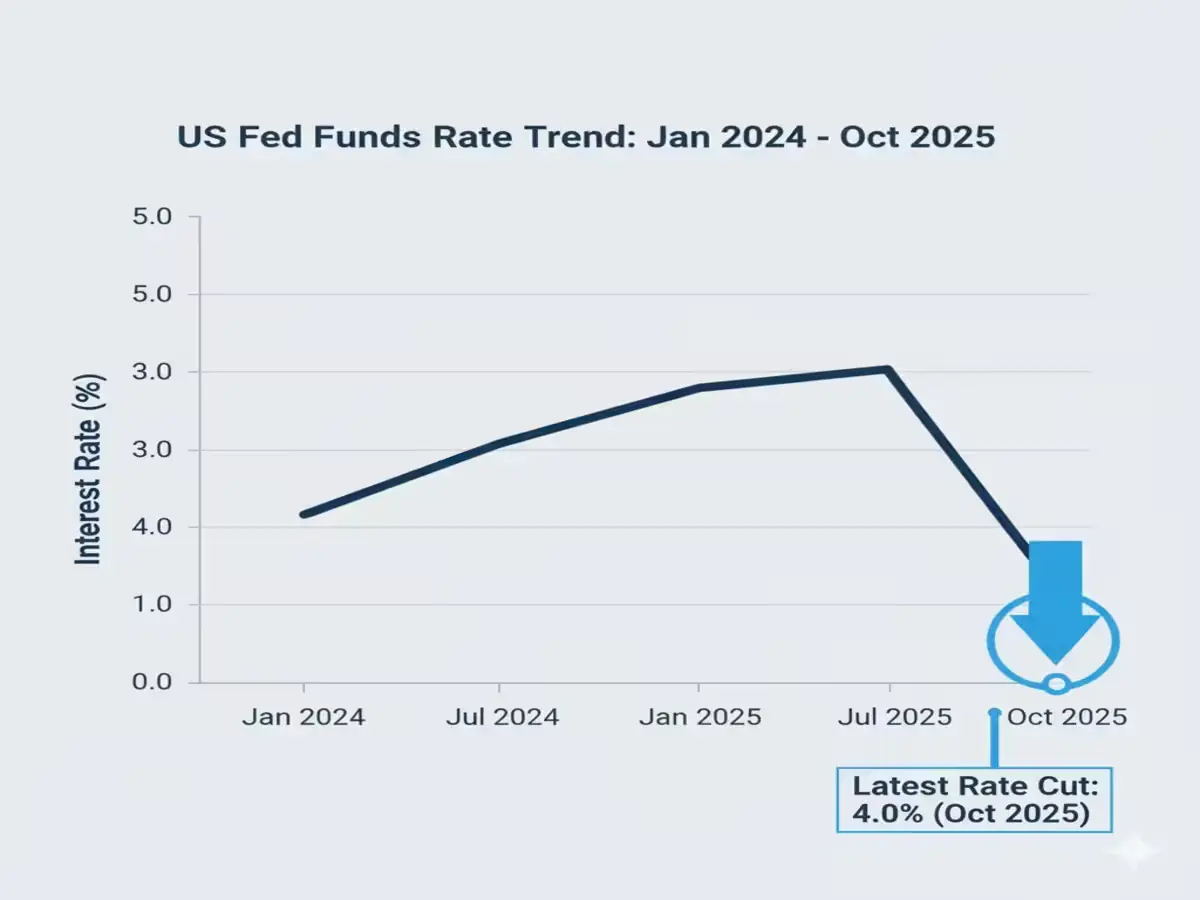

Discover Highlight: The Federal Reserve trimmed its benchmark rate to 3.75% – 4.00% in a widely watched move at the October FOMC meeting. The decision signals a cautious shift toward supporting jobs while keeping inflation in check. Here’s a simple breakdown of what the US Fed rate cut means, the key takeaways from the meeting, and how markets reacted.

US Fed Rate Cut: What the Federal Reserve’s Interest Rate Decision Means

The Federal Reserve on Wednesday announced a 25-basis-point rate cut, setting the target range for the federal funds rate at 3.75%–4.00%. The decision came at the end of the Federal Open Market Committee (FOMC) meeting, marking a cautious but notable shift in the central bank’s approach as it weighs slower job growth against persistent inflation pressures.

Why the Fed Cut Rates

The Fed’s dual mandate – promoting maximum employment and stable prices — guided the latest move. With the labour market showing early signs of cooling and price pressures easing slightly, policymakers decided a modest reduction would help sustain growth without reigniting inflation.

Fed Chair Jerome Powell emphasized during his post-meeting speech that the decision was “data-driven” and that future actions will depend on how inflation and employment evolve. He cautioned that this should not be seen as the start of an aggressive rate-cut cycle.

Market Reaction and Key Takeaways

Equity markets responded positively, while Treasury yields dipped as investors priced in a slightly easier monetary path. The US dollar initially weakened, reflecting the shift in sentiment around US interest rate expectations. Analysts say the tone of the FOMC statement was balanced – supportive, but not overly dovish.

Meanwhile, traders on platforms like Forex Factory and other financial forums focused on how the Fed’s decision could influence upcoming inflation prints and currency movement. The next FOMC meeting and upcoming economic data releases will determine whether this cut becomes part of a broader trend.

Comparison with Previous Fed Actions

Earlier this year, the Fed had held rates steady, maintaining its fight against inflation. The October move marks a partial policy pivot — signaling flexibility rather than a full reversal. Historically, similar measured cuts have been used to stabilize employment during uncertain periods.

What It Means for Borrowers and Investors

For borrowers, slightly lower rates could mean cheaper mortgages and personal loans, though changes may take weeks to filter through. Investors may see renewed appetite for equities and corporate bonds, as lower yields on government securities make risk assets relatively more attractive.

Q&A: Common Questions on the Fed Rate Cut

Q1. What did the Fed decide in its latest meeting?

A1. The Federal Reserve lowered its target federal funds rate by 25 basis points to 3.75%–4.00%. This is the second rate cut of the year and reflects concern about slowing job growth.

Q2. Why did the Federal Reserve cut rates now?

A2. The Fed cited cooling employment data and easing inflation pressures. The decision aims to support economic momentum while keeping inflation expectations anchored.

Q3. Will there be more rate cuts this year?

A3. Fed Chair Jerome Powell clarified that future cuts will depend entirely on incoming data. The committee has not committed to a series of cuts but remains flexible.

Q4. How does this affect borrowers and savers?

A4. Borrowers could see slightly lower interest rates on loans and mortgages, while savers may earn less on deposits. Investors often view rate cuts as supportive for equities.

Q5. What should traders watch next?

A5. Traders are watching for fresh job and inflation data before the next FOMC meeting. Powell’s upcoming speech will also offer clues on whether further policy adjustments are likely.