The income tax refund process in India usually works smoothly, but many taxpayers experience an ITR refund delay during peak filing seasons. An income tax refund is issued when the tax paid is more than the actual tax liability. While refunds are typically credited within a few weeks, some returns take longer to process due to verification issues, data mismatches or backend delays.

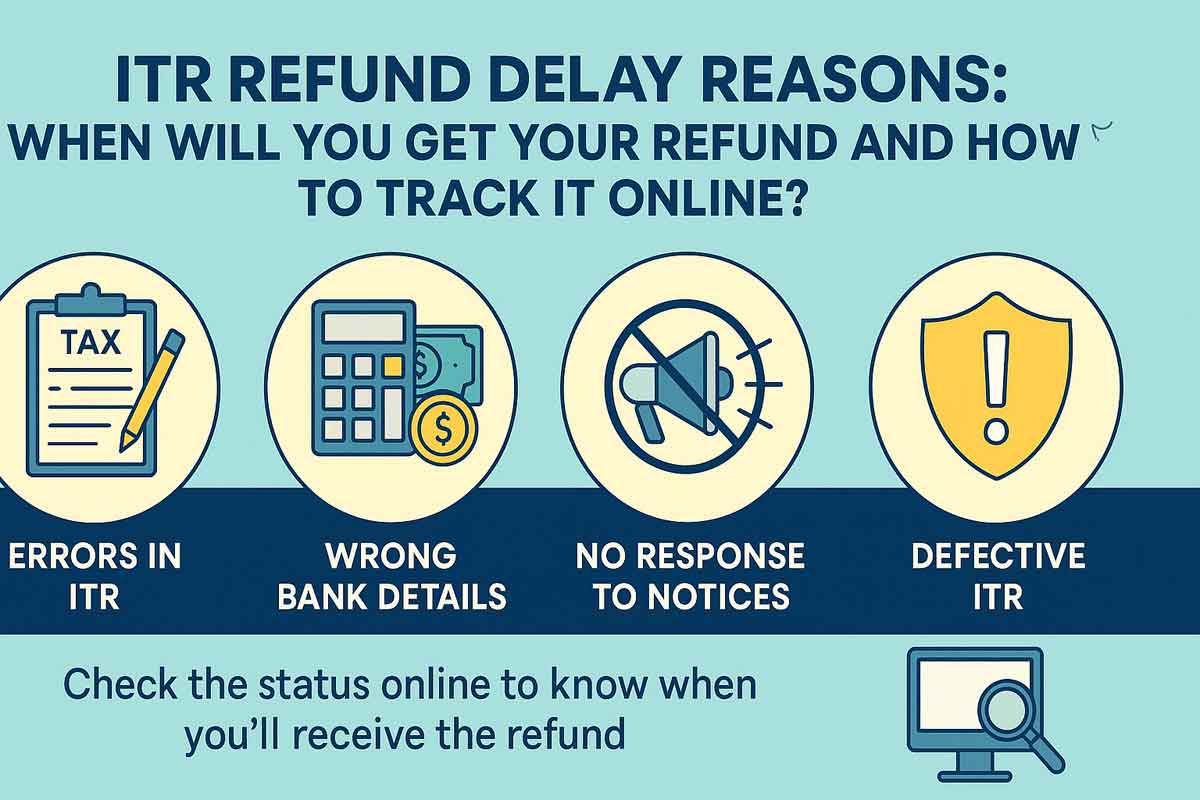

Reason for ITR Refund Delay

An ITR refund delay can occur due to several processing-related factors. In many cases, the Income Tax Department must re-verify data, match TDS information or confirm bank account details before releasing the refund. Even a small mismatch can slow the process.

Why Is the Refund Process Getting Delayed?

Several factors contribute to slower processing of income tax refunds, such as:

- Higher volume of ITR filings during peak season

- Manual verification required for certain claims or deductions

- Mismatch between TDS, Form 26AS and information entered in the return

- Banks taking longer to validate account details for refund credit

- Refund placed on hold due to pending responses to notices or queries

When Will Your ITR Refund Be Credited?

In most cases, refunds are credited within 20–45 days after processing begins. However, if your ITR has been selected for detailed verification, it may take longer. Taxpayers who filed early usually receive refunds faster, while returns filed closer to the deadline may experience delays due to high workload.

If all details are correct and no additional verification is required, refunds often get credited shortly after intimation under section 143(1) is issued.

Common Reasons for Delays in Receiving Refunds

- Incorrect bank details: Wrong account number or IFSC code leads to refund failure.

- Mismatch in Form 26AS, AIS or TDS: System holds refund until discrepancies are resolved.

- PAN and Aadhaar not linked: Refund may be paused until linkage is completed.

- ITR verification pending: Refund cannot be issued until you verify the return.

- Response to notice not submitted: If the IT department raises a query, refund is withheld.

- Incorrect tax computation: Refund is recalculated, causing delay.

How to Check ITR Refund Status Online?

You can track your refund status online through two platforms:

1. Through the Income Tax Portal

- Visit the official Income Tax portal

- Login using your PAN and password

- Go to “e-File” → “Income Tax Returns” → “View Filed Returns”

- Select the assessment year

- Check refund status under the “Status” column

2. Through the Refund Processing Bank (CPC refund tracking)

- Visit the refund tracking page of the authorized bank

- Enter PAN and assessment year

- View whether the refund is processed, paid or failed

If the refund shows “failed,” updating bank details in the e-filing portal and re-validating the account usually helps.

Disclaimer

This article provides general information on ITR refund delay based on publicly available guidance. Refund timelines vary depending on individual cases, department workload and verification requirements. For specific issues, taxpayers should refer to the official Income Tax portal or consult a tax professional.

FAQs

Q1. When will I get my ITR refund?

Most taxpayers receive their refund within 20–45 days after processing. Delays occur if verification or data corrections are needed.

Q2. What should I do if my income tax refund is delayed?

Check refund status online, verify bank details, ensure ITR verification is completed and respond to any notices from the department.

Q3. How can I check my ITR refund status online?

You can check refund status on the Income Tax portal under “View Filed Returns” or through the refund tracking page of the processing bank.