- Asian Paints share price jumps after Q2 profit rises by 43%.

- Interim dividend of ₹4.50 per share announced for shareholders.

- Market watchers hint at a strong festive-season demand boost ahead.

Asian Paints Share Price Rises After Q2 Profit Jump & Dividend News

Asian Paints has once again captured investor attention after announcing strong quarterly numbers. The asian paints share price saw a noticeable jump following the company’s second-quarter earnings release, reflecting renewed optimism about domestic demand and steady growth in its decorative paints segment.

About Asian Paints

Asian Paints is India’s largest decorative coatings company and a key name in the home-improvement segment. Whenever investors track the asian paints share or search for asian paint share price, they’re often looking for cues on how consumer sentiment and housing trends are shaping the broader economy.

Quarterly Results: Growth on Solid Ground

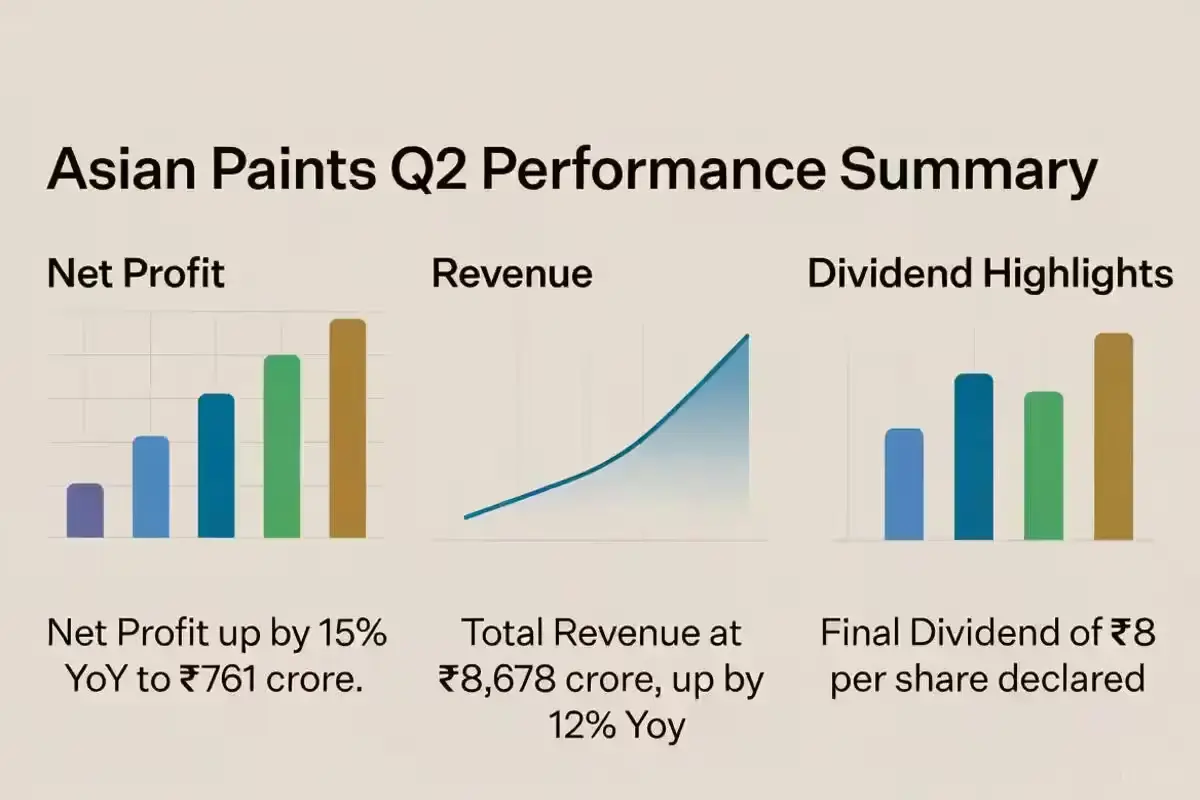

In its latest quarterly results, Asian Paints reported a net profit growth of around 43% compared to the same period last year. Revenue also moved upward, showing that even with inflationary pressures, consumer demand for home renovation and decorative paints remains strong. The domestic decorative segment recorded double-digit volume growth, while the industrial and international businesses maintained stable performance.

Following the announcement, the asian paints share price rose sharply during intraday trade, touching a fresh 52-week high. The move was driven by strong profit margins and a positive tone in management commentary about the festive quarter.

Dividend Announcement

Adding to investor confidence, the company declared an interim dividend of ₹4.50 per share. The payout highlights the brand’s strong cash position and consistent approach to rewarding shareholders. For those tracking asian paint share price trends, dividend news often triggers renewed buying interest in the counter.

Market Mood and Stock Reaction

The broader market also seemed to favor paint stocks, with Asian Paints standing out due to its consistent financial performance. Analysts believe the current demand momentum, supported by urban renovation projects and rural housing schemes, could sustain earnings in the coming quarters.

The asian paints share price has already reflected much of the near-term optimism, but long-term investors continue to view it as a steady compounder in the consumer discretionary space.

Key Triggers to Watch Ahead

Here are some important points for investors tracking asian paints share price in the coming months:

- Raw-material cost trends, particularly crude derivatives.

- Festive-season sales in decorative paints.

- Volume growth in rural and tier-II cities.

- Performance of new premium product lines.

Clickbait Insight for Google Discover 📈

Investors are calling this “the comeback quarter” for Asian Paints — after months of sideways movement, the stock is showing signs of renewed momentum. With festive demand picking up and management focusing on premium paints, the next few months could prove crucial for anyone watching the asian paints share price trend. Could it touch a new all-time high by year-end? That’s the question traders are now asking.

Final Word

Asian Paints continues to demonstrate stability and brand strength in a competitive segment. For long-term investors, the company’s consistent growth, dividends, and ability to manage costs make it one of the most watched names in the FMCG-adjacent space. Still, investors should stay alert to raw-material price swings that can impact margins and, in turn, the asian paint share price trajectory.

Frequently Asked Questions (FAQ)

Q1. What is the current asian paints share price?

A: The asian paints share price recently traded near its 52-week high after the company posted strong Q2 results and announced a dividend.

Q2. Did Asian Paints declare any dividend recently?

A: Yes, the company announced an interim dividend of ₹4.50 per share, rewarding shareholders for steady financial performance.

Q3. What caused the recent rise in asian paints share price?

A: The rise was driven by strong profit growth, solid decorative volume expansion, and positive management commentary on demand trends.

Q4. Is Asian Paints considered a long-term stock?

A: Many investors view Asian Paints as a long-term compounder due to its strong brand, steady margins, and consistent dividend history.

Disclaimer: This article is for informational purposes only. It is not financial advice. Please consult a professional advisor before investing.