GST Payment Update: UPI & Cards Now Accepted, Interest on Delayed Refunds Explained

Taxpayers have a reason to smile — paying GST just got simpler. The Goods and Services Tax Network (GSTN) recently enhanced its payment options, allowing businesses and individuals to pay their GST dues using UPI and debit/credit cards. Alongside this upgrade, two new banks — Indian Overseas Bank and Bandhan Bank — have been added to the list of authorized banks for GST payments across 26 states and union territories.

What’s New in the GST System?

Until now, GST payments were largely restricted to net banking through select banks. With this latest enhancement, users can now complete their transactions directly using UPI or cards, making the process faster and more accessible. The move aims to simplify tax compliance for small businesses and individual taxpayers who rely on mobile payments or prefer card-based transactions.

Why This Matters to You

This change isn’t just about convenience — it’s about inclusion. By bringing in more banks and payment channels, GSTN is opening the door for millions of users who previously faced delays or limited options. The update also helps prevent common banking errors during peak payment times by offering multiple digital modes.

Interest on Delayed GST Refunds

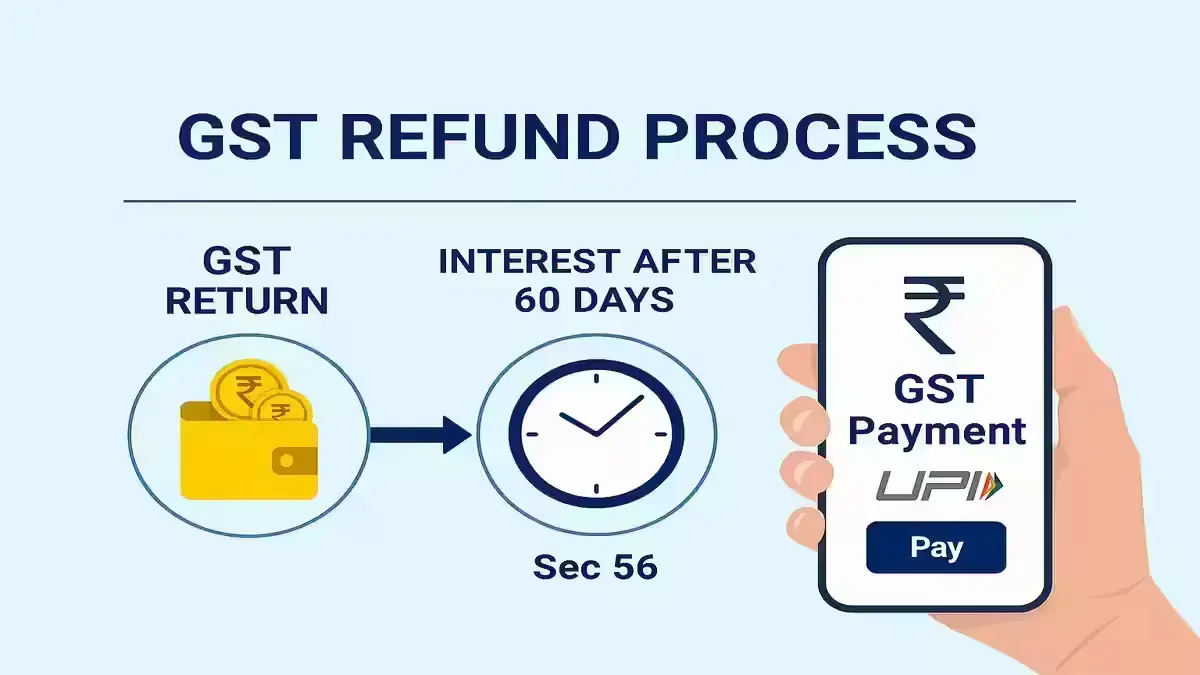

Along with the payment updates, there’s an important clarification regarding the 56 GST Act. If a taxpayer’s undisputed refund is delayed beyond 60 days from the date of application, interest will automatically start accruing. This interest continues until the refund amount is credited to the taxpayer’s account. The provision ensures fairness and accountability, reducing the financial burden on businesses waiting for their due refunds.

Impact on Businesses

For business owners and traders, these changes bring both flexibility and transparency. Whether you maintain a savings account with one of the newly added banks or rely on UPI for daily transactions, the improved payment structure saves time and reduces compliance headaches. It’s another step toward a more digital-friendly tax environment that supports India’s growing fintech ecosystem.

Key Takeaway

With UPI and card payments now part of the GST system and clearer refund rules under Section 56, taxpayers can expect smoother operations ahead. The combination of broader payment options and timely interest accrual on refunds signals a modern, citizen-centric approach to tax management.

Disclaimer

This article is for general informational purposes only. Please consult your tax advisor or check the GST portal for the most up-to-date information on payment and refund policies.

FAQ

Q: Which banks have been added to GST payment options?

A: Indian Overseas Bank and Bandhan Bank are now authorized to process GST payments through the GST portal.

Q: Can I pay GST using UPI or a credit card?

A: Yes, UPI and debit/credit card options are now available for GST payments in most states and union territories.

Q: When does interest start on a delayed GST refund?

A: Interest begins automatically after 60 days from the date of refund application, continuing until the refund is received.