VMS TMT IPO GMP, price band, allotment status, subscription data, and listing date explained in a simple guide for retail investors.

VMS TMT IPO GMP, Price Band, Allotment Status & Listing Details

About VMS TMT IPO GMP

The VMS TMT IPO has drawn attention in the primary market, especially as investors track the VMS TMT IPO GMP (Grey Market Premium). Grey market activity often gives an early sense of investor sentiment ahead of listing. The issue comes at a time when multiple small and mid-cap IPOs, including Euro Pratik IPO, are also hitting the market.

VMS TMT Price Band, Share Price & Lot Size

The company has announced its IPO price band, which is structured to attract retail participation. Investors can apply for a minimum lot size designed to make entry affordable while ensuring adequate retail allocation. The VMS TMT shares have generated curiosity in the market, thanks to their valuation compared to sector peers.

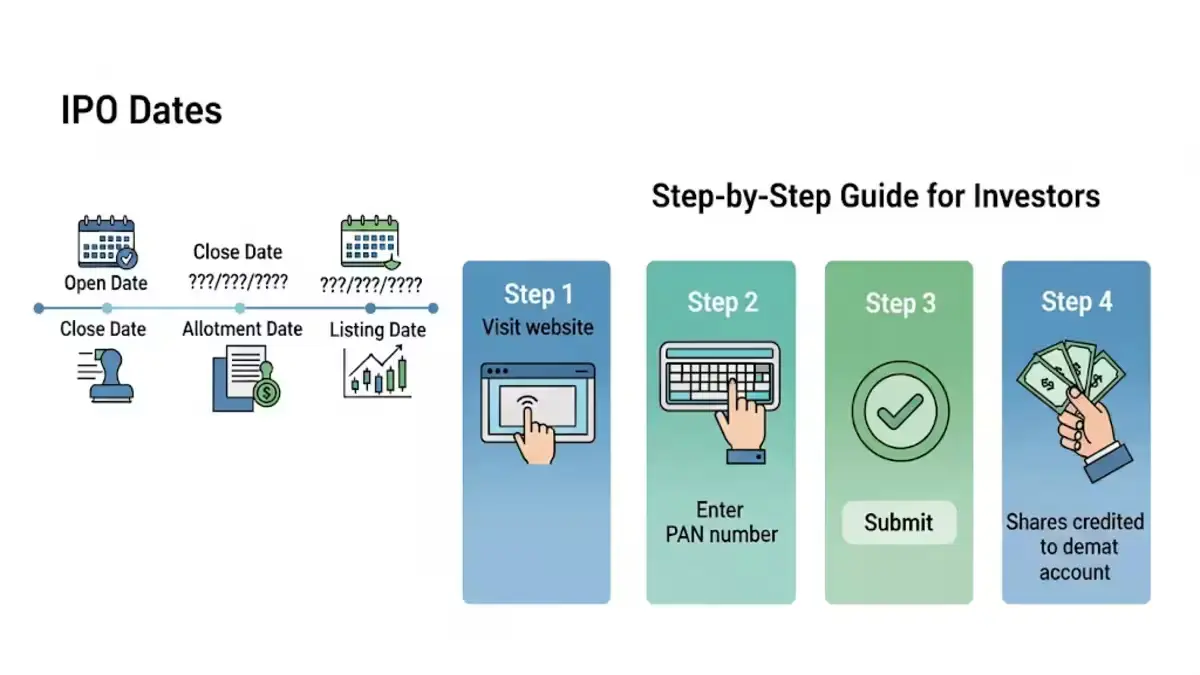

IPO Dates – Open & Close

- IPO Opening Date: To be announced

- IPO Closing Date: To be announced

- Allotment Date: Expected shortly after close

- Listing Date: Expected within a week of allotment

Allotment Status & Step-by-Step Guide

Allotment Status & Step-by-Step Guide

Once the IPO closes, investors can check their allotment status online. Here’s a quick step-by-step guide:

- Visit the official registrar’s website after allotment date.

- Enter PAN number, application number, or DP/Client ID.

- Submit the details to check if shares have been allotted.

- If allotted, shares will be credited to your demat account before listing.

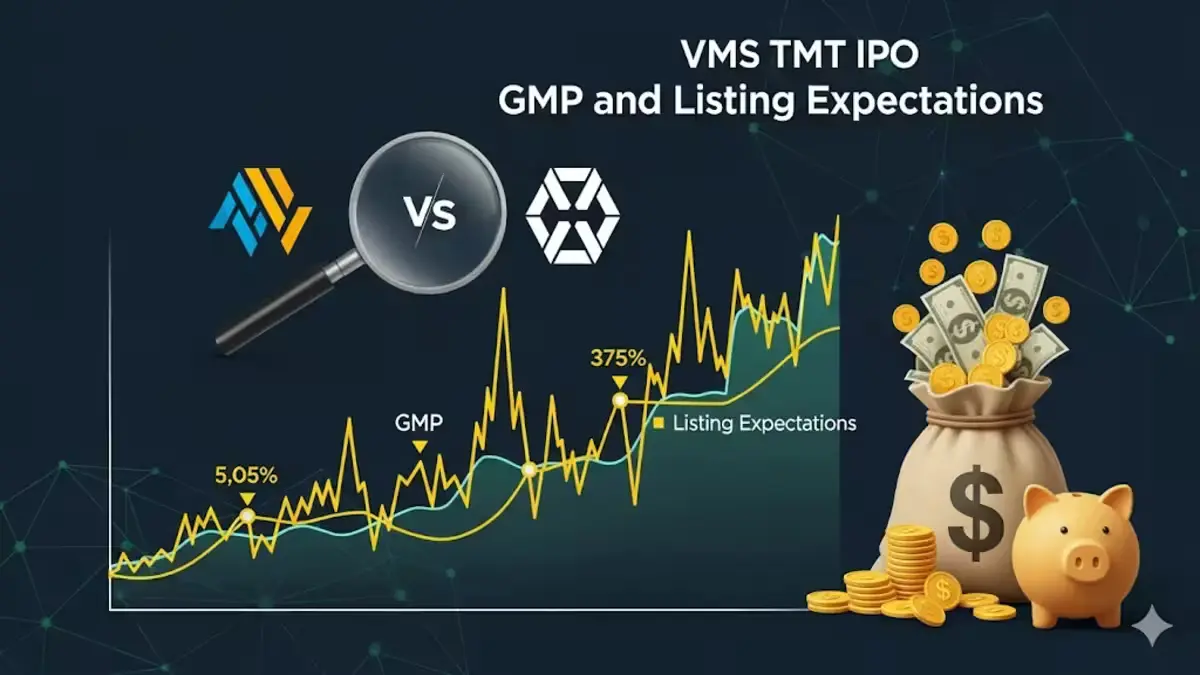

VMS TMT IPO GMP & Listing Expectations

The VMS TMT IPO GMP has been fluctuating, reflecting broader market trends. Investors often compare GMP with other ongoing IPOs like the Euro Pratik IPO GMP to gauge demand. While GMP offers insights, actual listing gains depend on final subscription numbers and market sentiment.

Market Cap & Subscription Details

Market Cap & Subscription Details

The IPO is expected to boost the company’s market capitalization, strengthening its position in the steel and TMT bar manufacturing segment. Subscription numbers will be closely watched, as oversubscription in retail and HNI categories often drives strong listing performance.

Corporate Events: Dividends & Bonus Updates

At this stage, there are no confirmed dividend or bonus updates. However, investors tracking VMS TMT shares should monitor corporate announcements post-listing for updates on buyback or dividend policies.

Multibagger Potential

With strong demand for infrastructure and steel products, analysts believe companies like VMS TMT could show multibagger potential in the long term. However, investors should also be mindful of risks such as commodity price fluctuations and cyclical demand patterns.

Disclaimer

This article is for informational purposes only. It does not constitute investment advice or a recommendation. Investors should consult financial advisors before investing in VMS TMT shares or other IPOs like Euro Pratik IPO.

FAQs

Q1: What is the GMP of VMS TMT IPO?

A: The VMS TMT IPO GMP is being tracked in the grey market and may vary daily before listing.

Q2: How can I check my VMS TMT IPO allotment status?

A: Investors can check the allotment status on the registrar’s website using their PAN, application number, or DP ID after allotment is finalized.

Q3: Are there any dividend or bonus announcements for VMS TMT shares?

A: As of now, no dividend or bonus announcements have been made. Updates may come after listing.