GST Rate Cuts: A Strategic Move for Economic Growth

What the GST Rate Cuts Entail

Under the new GST structure, the government has streamlined the tax system by eliminating the 12% and 28% slabs. The revised rates are:

- 5%: For essential goods and services

- 18%: For most other items

- 40%: For luxury and sin goods

This simplification aims to reduce compliance burdens and make everyday goods more affordable for consumers.

Financial Implications

According to SBI’s research, the central government’s revenue loss due to these rate cuts is estimated at ₹3,700 crore. However, the government anticipates that the overall fiscal impact will be ₹48,000 crore annually. This discrepancy is attributed to expected increases in consumption and tax collections, which are projected to offset the revenue shortfall.

Economic Growth Prospects

The SBI report suggests that the GST reforms are likely to be growth-accretive, boosting consumption while keeping fiscal risks in check. The reduction in tax rates is expected to lower the cost of goods and services, thereby increasing disposable income and encouraging spending. This uptick in consumption is anticipated to drive economic growth and support various sectors, including manufacturing and retail.

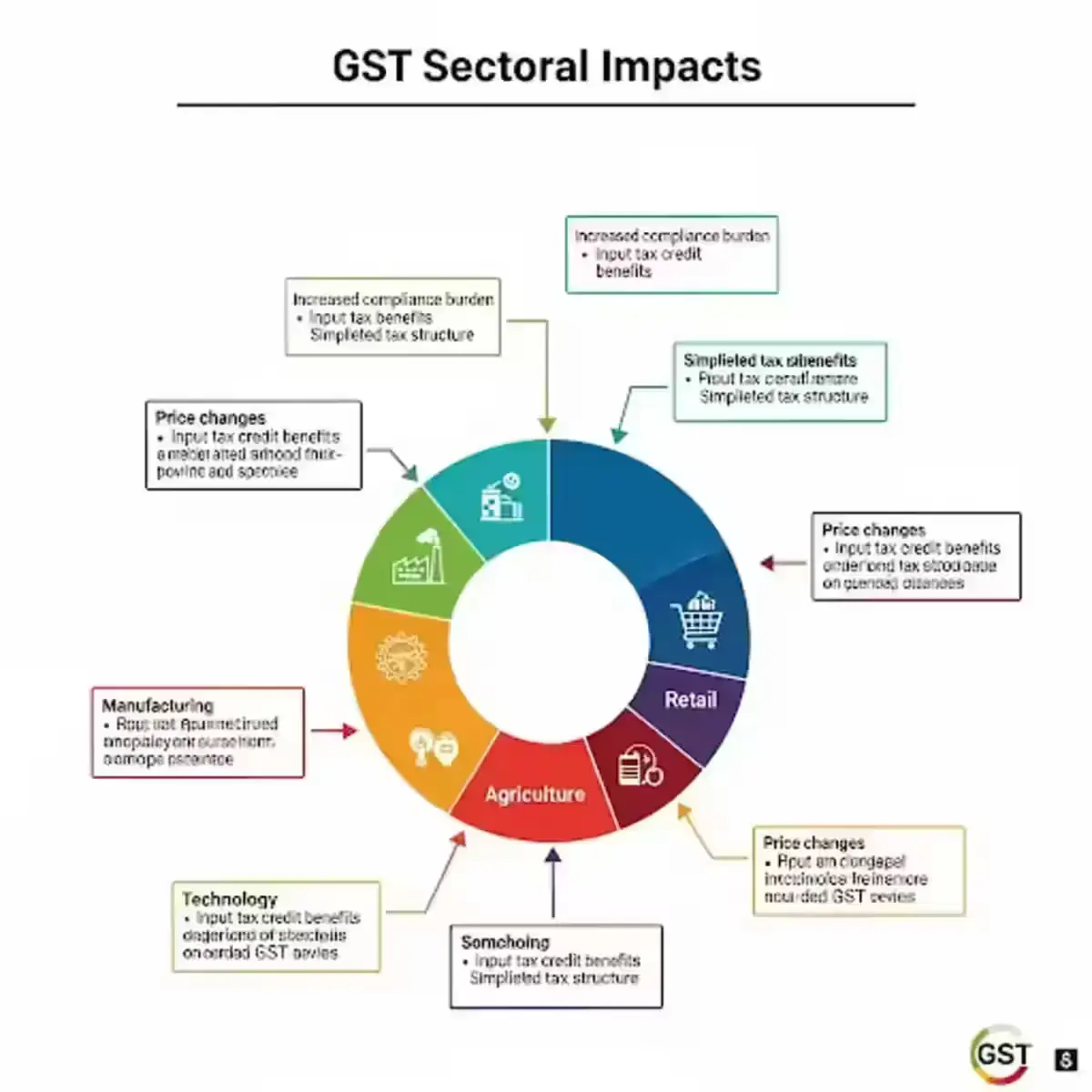

Sectoral Impacts

Several sectors are poised to benefit from the GST rate cuts:

Several sectors are poised to benefit from the GST rate cuts:

- Automobile Industry: The reduction in GST on vehicles is expected to make cars and motorcycles more affordable, potentially boosting sales in the automotive sector.

- Healthcare: Lower taxes on medical supplies and services could reduce healthcare costs, making them more accessible to the public.

- Consumer Goods: Everyday items such as food, clothing, and household products are likely to become cheaper, easing the financial burden on consumers.

Regional Benefits

Certain states are projected to gain more from the GST rate rationalisation. For instance, West Bengal is expected to receive a significant financial boost, with estimates suggesting an additional ₹30,000 crore in revenue due to the new tax structure.

Implementation Timeline

The revised GST rates are scheduled to come into effect on September 22, 2025, ahead of the festive season. This timing is strategic, aiming to maximize the economic impact during a period of increased consumer spending.